Last Updated Oct 14, 2025

Overview

Tickeron offers AI-powered trading bots that provide real-time signals across multiple timeframes for active investors. However, users note that effective use requires understanding market dynamics and bot setup. Still, its range of Signal, Virtual, and Brokerage agents delivers flexibility and transparency for those pursuing automated trading strategies.

Be the first one to leave a review!

No review found

Starting Price

Custom

Tickeron Specifications

Self-Service Dashboards

Automation

Bot Design And Deployment

Predictive Capabilities

What Is Tickeron?

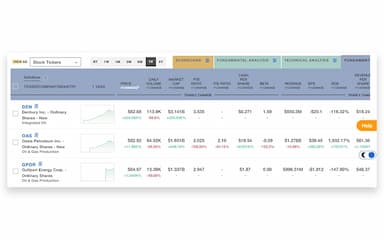

Tickeron is an AI-powered trading platform that enables investors to automate strategies and analyze markets through intelligent trading bots. It offers three bot types that are Signal Agents for real-time copy trading, Virtual Agents for portfolio and risk management, and Brokerage Agents for direct trade execution using tick-level data. Operating across 5, 15, and 60-minute timeframes, Tickeron helps traders align automation with their preferred risk levels and market activity.

Tickeron Pricing

Tickeron offers four pricing options designed to suit traders and investors of different experience levels.

- Investor: $60/month

- Swing Trader: $80/month

- Day Trader: $90/month

- Expert: $250/month

Disclaimer: The pricing is subject to change.

Tickeron Integrations

Who Is Tickeron For?

Tickeron software is ideal for a wide range of industries and sectors, including:

- Retail trading and investing

- Financial advisory firms

- Quantitative researchers

- Hedge funds

- Wealth management

- Cryptocurrency trading

- Education and trading communities

Is Tickeron Right For You?

Tickeron may be the right choice for traders seeking AI-driven automation with transparent performance insights. Its Signal Agents support beginners exploring copy trading, while Virtual and Brokerage Agents cater to experienced users managing portfolios and executing trades. With multi-timeframe options and real-market data, Tickeron offers flexibility for diverse trading goals.

Still doubtful if Tickeron is the right fit for you? Connect with our customer support staff at (661) 384-7070 for further guidance.

Tickeron Features

Tickeron offers Signal, Virtual, and Brokerage agents. Signal agents generate copy-trading signals without requiring account balances, making them accessible to novices. Virtual agents add portfolio management and risk controls for more experienced traders, while Brokerage agents provide direct execution and display real-money performance for transparency.

Bots operate on 5-, 15-, and 60-minute timeframes to capture different market dynamics. Short interval bots aim to exploit micro trends, medium interval bots balance trade frequency and reliability, and longer interval bots provide stability with fewer trades. Users can select timeframes that suit their risk appetite and strategy.

Tickeron supports single, double, multi, and hedge configurations. Single agents trade one security, while double agents manage correlated or inverse positions to control risk. Multi agents diversify across sectors, and hedge agents combine long and short strategies for consistent returns. These options allow traders to customize bots according to their risk management preferences.

The platform publishes annualized returns for various bots, with reported figures ranging from 43 percent to 362 percent for certain strategies. Brokerage agents display real-money performance, giving traders confidence in the bots’ historical results and enabling informed decision-making.

Tickeron’s bots leverage machine learning algorithms to identify patterns and manage risk through stop loss and take profit mechanisms. Signal agents require no minimum balance, while virtual agents handle allocation and sizing, ensuring a balance between automation and user control.