The personal finance software landscape is evolving rapidly as both individuals and businesses seek smarter, more efficient ways to manage their finances. Platforms like YNAB and Truebill are at the forefront of this shift, each offering a unique approach to budgeting, goal setting, and financial tracking.

YNAB is known for its goal-oriented approach that promotes proactive money management, while Truebill excels in automation, subscription monitoring, and delivering financial insights. Both tools are popular, yet they cater to different financial styles and user preferences.

In this YNAB vs Truebill comparison, we’ll explore their key features, pricing structures, advantages, and drawbacks to help you determine which platform best fits your financial management goals.

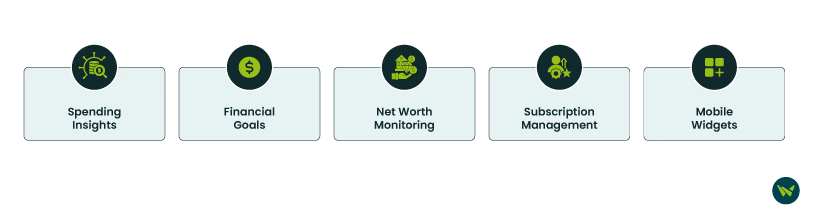

Feature | YNAB | Truebill |

Spending Insights | Offers a stack-ranked view of your top spending categories | Personalized spending allowances with real-time alerts |

Financial Goals | Color-coded progress bars and personalized financial goals | Smart automation to analyze spending behavior with multiple savings plans |

Net Worth Monitoring | Detailed monthly breakdown, calculating assets and liabilities | Wide-ranging tracking options and customization |

Subscription Management | Allows to invite up to five people, Recent Moves to track changes | Central hub for all your recurring expense |

Mobile Widgets | Budget insights, display specific categories | Real-time visibility into key financial details |

Pricing Model | Subscription-based pricing | Subscription-based pricing |

YNAB (You Need A Budget) is a popular budgeting software designed to help businesses manage their finances effectively. The core philosophy of YNAB is based on a simple principle: ‘Give every dollar a job.’

This means users allocate every dollar they earn to specific spending categories, savings, or financial goals, ensuring intentional and mindful spending. The platform is designed to help users take control of their money, reduce financial stress, and achieve their financial goals.

Standout Features

- Bank Connectivity: YNAB lets users link their bank accounts directly, so transactions are automatically pulled in, making it easy to stay current and conscious of spending

- Goal Tracking: Users can set financial targets, such as emergency funds or car repairs, and visually monitor their progress. A ‘target-setting’ feature clarifies how much more is needed and when

- Loan Calculator: This feature is designed to help you take control of your debt with clarity and motivation. It shows you exactly how much interest and time you can save by making extra payments toward your loans

- Reporting And Charts: The software offers graphical reporting, including category spending, trends, and net worth visualizations, offering data-rich insights into financial habits and long-term progress

Pros And Cons

Pros

- Provides extensive support resources and learning materials

- Allows account sharing with up to six users

- User-friendly interface enhances the overall experience

Cons

- No options for investment tracking or bill payments

- The platform doesn’t offer free credit reports and scores

Truebill (now Rocket Money) is a cloud-based financial management platform known for its powerful subscription tracking capabilities. It helps users take charge of their finances by making it easy to cancel unwanted services and offering clear insights into spending patterns. With built-in budgeting tools, the platform also strengthens financial strategy by monitoring users’ net worth and credit scores.

Standout Features

- Balance Alerts: Delivers real-time updates on account balances, helping businesses maintain a clear view of credit usage

- Budgeting Tools: Provides detailed analysis of transactions, enables monthly spending limits by category, and includes visual goal trackers and reminders to help users stay on target

- Account Sharing: Facilitates easy sharing of financial data with family members, friends, or financial advisors, promoting transparency and collaboration in budgeting

- Custom Budgets: Enables users to create unlimited budget categories tailored to their needs, making it ideal for tracking departmental or project-specific spending

Pros And Cons

Pros

- Consolidates finances and tracks real estate value automatically

- Monitors subscriptions to prevent unwanted service payments

- Offers insights to improve personal spending awareness

Cons

- Customer support availability is somewhat restricted

- Budgeting tools are limited

YNAB offers a monthly plan for $14.99/month with a 34-day free trial.

Disclaimer: The pricing is subject to change.

Truebill software offers businesses a free and premium plan. Here’s the breakdown:

- Free Plan: Free forever

- Premium Plan: $6 to $12/month after 7-day free trial

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

Both YNAB and Truebill offer powerful financial management tools, but they serve different user preferences. YNAB is ideal for those who prefer a structured approach, offering tools such as customizable widgets, in-depth goal tracking, and collaborative budgeting through subscription sharing. It’s designed for users who want full control over their finances and a clear long-term strategy.

On the other hand, Truebill prioritizes automation and simplicity. With powerful subscription cancellation, smart savings features, and real-time spending alerts, it streamlines financial management for users who want to stay informed without needing detailed planning.

Ultimately, the best choice depends on your financial style; YNAB suits those who value proactive budgeting, while Truebill is better for those who prefer a more automated, low-effort approach to staying financially on track.