2025 Security SaaS Report: How Trust Drives Buyer Choice, Retention, and Revenue

Today’s buyers demand confidence. Security has become the core criterion shaping SaaS decisions, from first evaluation to renewal. In this report, built on Software Finder’s analysis of 2024-25 buyer activity, we show how trust influences revenue and reveal the strategies leading vendors are using to win in a security-first market.

Discover

How Impacts SaaS Buyers

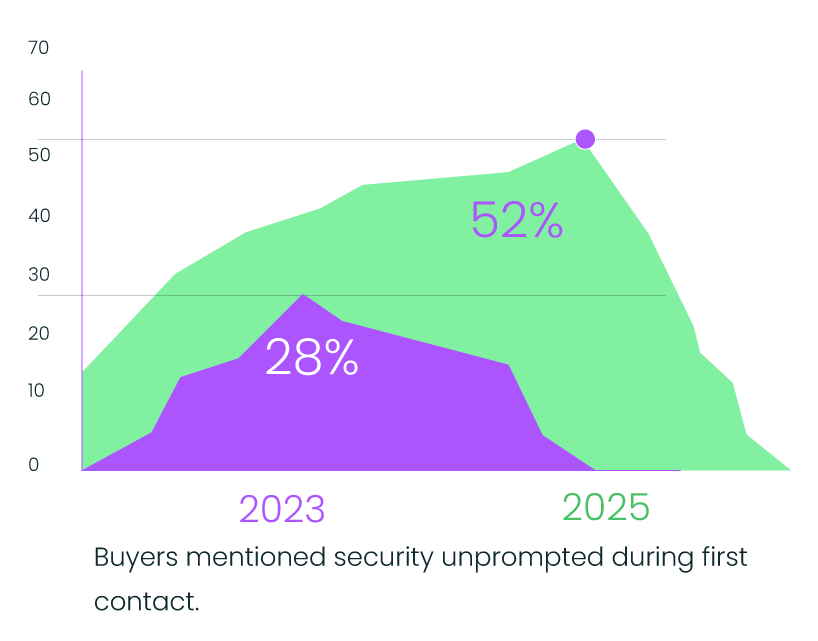

The buyer journey begins with one question: can we trust this vendor? Security is now the defining filter for SaaS purchases. A 300% surge in breaches in 2024 forced organizations, especially in healthcare, finance, and manufacturing, to reassess their stacks. By 2025, 93% of CISOs call SaaS security a top priority, and more than half of B2B buyers bring up security in the very first conversation, a dramatic rise from 28% in 2023.

The buyer journey begins with one question: can we trust this vendor? Security is now the defining filter for SaaS purchases. A 300% surge in breaches in 2024 forced organizations, especially in healthcare, finance, and manufacturing, to reassess their stacks. By 2025, 93% of CISOs call SaaS security a top priority, and more than half of B2B buyers bring up security in the very first conversation, a dramatic rise from 28% in 2023.

Buyer expectations have shifted sharply over the past year. Certifications and transparency are now seen as basic requirements, secure-by-default features are demanded in nearly every RFP, and AI usage policies are under close scrutiny.

| Certifications and Transparency Are Non-Negotiable | Secure-by-Default Features Are Mandatory | AI Transparency Is Under Scrutiny |

SOC 2 Type II is now a baseline entry requirement for most demos, while HIPAA and ISO 27001 are mandated in regulated industries. In 43% of cases, buyers disqualified vendors for failing to provide verifiable credentials. | Security is no longer a premium add-on. MFA, SSO, RBAC, encryption, and audit logs are considered non-negotiable, with 68% of RFPs explicitly requiring MFA and SSO in base plans. | As generative AI features expand across SaaS, buyers want clarity on whether their data is used to train LLMs, which third-party AI services are involved, and whether opt-outs are available. Vendors that cannot answer these questions risk delays or disqualification. |

Transform

Sales Strategy For B2B Buyers

Enterprise RFPs are increasingly shaped by certification thresholds. SOC 2 Type II is treated as a minimum requirement, while ISO 27001 and HIPAA surface in regulated contexts. In nearly half of competitive evaluations, missing or unverifiable credentials led to vendor disqualification.

Evaluation criteria have also expanded to cover product safeguards. MFA, SSO, RBAC, encryption, and audit logs are written directly into RFP language, with MFA and SSO explicitly required in 68% of cases. Vendors that frame these as add-ons face growing resistance.

A newer area of scrutiny is AI usage. Procurement teams now ask how data interacts with embedded models, which external providers are involved, and whether opt-outs are possible. When answers are vague, deals slow or stall altogether.

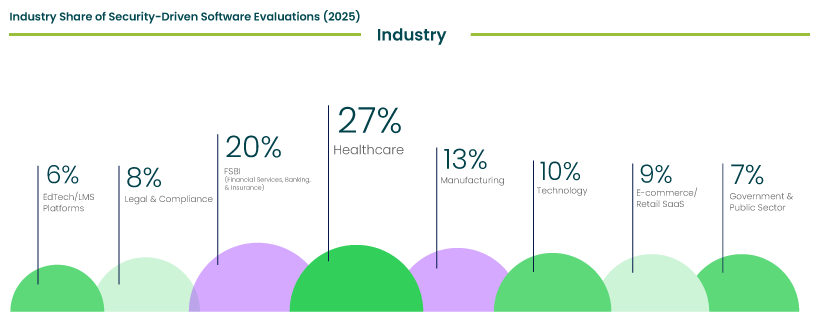

Security-driven evaluations are no longer confined to healthcare (27%) and financial services (20%), where regulation is most intense. Mid-tier industries like manufacturing (13%) and technology (10%) show that buyer scrutiny is rippling outward into less traditionally regulated spaces. Government (7%) and e-commerce (9%) underline that both public accountability and consumer trust are pushing security to the forefront. By 2025, every vertical faces pressure to prove resilience and transparency.

Leading vendors are leaning into transparency. Public trust centers with verified documentation cut deal cycles by almost a third.

Security features, MFA, SSO, RBAC, once reserved for higher tiers are now standard. Advanced controls like BYOK and AI data-use preferences are emerging as differentiators.

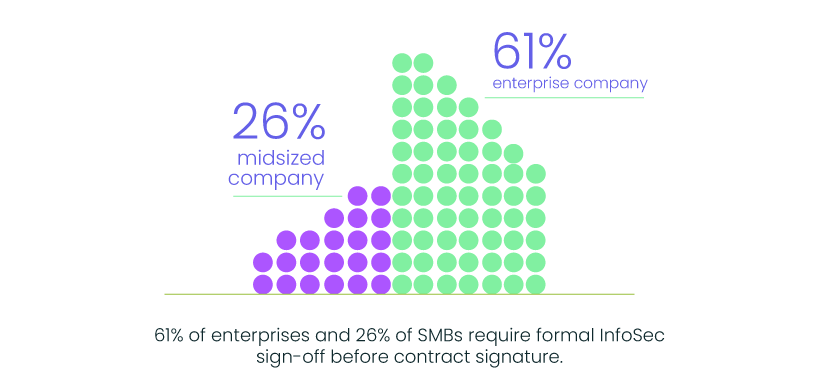

Sales motions are also shifting. Security packets are delivered early, and InfoSec specialists are now part of the sales process to meet growing sign-off requirements across enterprises and SMBs.

Boardrooms and buyers alike now view security as a business enabler. SaaS vendors that elevate trust to a core strategy are converting faster and retaining more customers.

We have found:

- 20% uplift in win rates when security responsiveness is visible in sales

- 16% lower churn when buyers feel security is proactively managed

- Shorter sales cycles when trust collateral is ready at hand

Methodology

This report is based on Software Finder’s proprietary analysis of thousands of buyer–vendor interactions between Q4 2024 and Q2 2025. The analysis covers thousands of activities including RFP submissions, shortlist adjustments, and vendor comparisons where security posture influenced decisions. Unlike survey-based studies, this approach reflects actual buyer behavior in live cycles.

The sample reflects a broad mix of U.S. companies, ranging from small and mid-sized businesses to large enterprises, and covering healthcare, financial services, manufacturing, HR tech, technology, legal, government, e-commerce, and EdTech. International patterns from Europe and APAC were also included, with GDPR and data residency requirements influencing many evaluations.

To ensure depth, Software Finder analyzed outcomes across three stages of the deal cycle: initial evaluation, shortlist modifications, and renewals. This was complemented by post-decision buyer feedback and an examination of trust collateral submitted by SaaS vendors, including SOC 2 attestations, penetration test summaries, and live trust centers. This multi-layered approach provides a reliable lens on how security expectations are shaping SaaS procurement in 2025.

Get

Strategies Engage SaaS Buyers

SoftwareFinder.com bridges the gap between buyers and vendors in today’s SaaS market. From HR and payroll to ERP and project management, our data-driven insights help buyers evaluate with confidence, while enabling vendors to showcase trust, compliance, and readiness.

Whether you want to showcase your product’s security posture or connect with qualified leads, Software Finder can help. Vendors can list their solutions through our Vendor Portal or request PPL leads, while buyers can explore categories to find SaaS platforms that meet their compliance and security needs.

This content may be referenced for noncommercial purposes. If you share or cite this data, please include a link back to SoftwareFinder.com for proper attribution.