As the specifications for digital budgeting tools grow smarter and more intuitive, choosing the right one can make all the difference in managing your money. Truebill and Mint stand out as two top contenders, each offering unique features to help businesses monitor spending, reduce waste, and stay on top of their financial goals.

Truebill focuses on reducing costs through features like canceling unused subscriptions, negotiating bills, and automating savings deposits. Mint, on the other hand, emphasizes budgeting, allowing businesses to set savings goals, track bills, monitor financial accounts, and view credit reports in one place.

This Truebill vs Mint comparison explores the core features, strengths, and limitations of each platform, highlighting what sets them apart to help you choose the best fit for your financial goals.

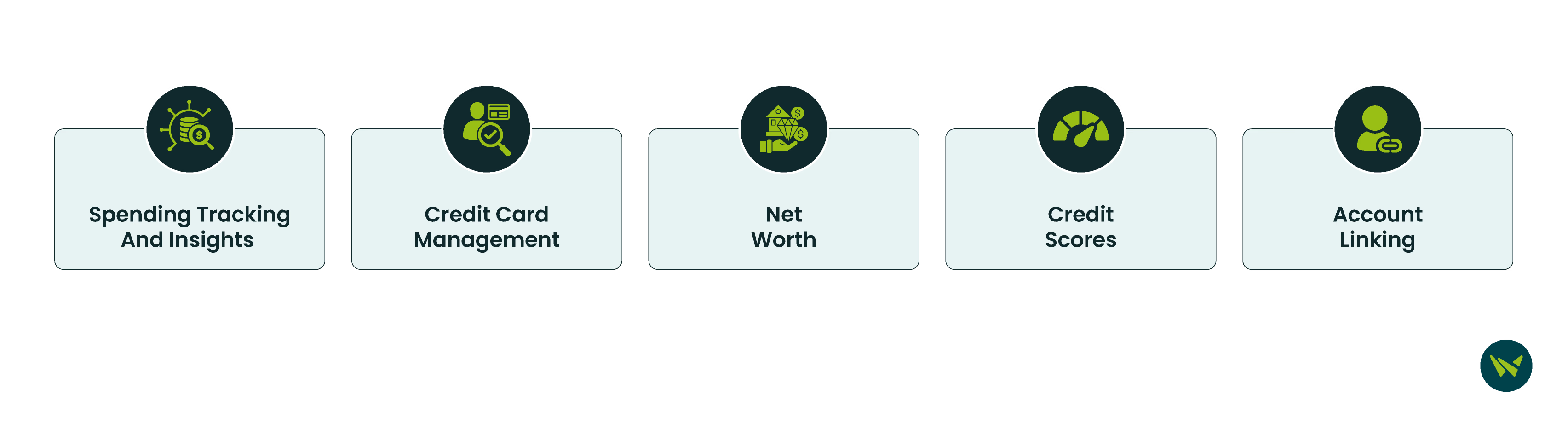

Feature | Truebill | Mint |

Spending Tracking And Insights | Real-time notifications, tracks spending behavior | Monitors subscriptions, hidden fees, and changes in spending |

Credit Card Management | Rocket Visa Signature Card, payment scheduling | Credit card calculators like debt repayment, sales tax, and bank transfer calculator |

Net Worth | Custom asset categories, automatic updates | Transaction history, e tracks retirement accounts, mortgages |

Credit Scores | Offers full credit report and history, real-time alerts about changes | Payment history, credit utilization, account mix, and recent inquirie |

Account Linking | Plaid API to link checking, savings, credit, investment, and loan account | Connects accounts from over 17,000 institutions |

Pricing | Starts at $6/month | Free |

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

Truebill software, now known as Rocket Money, is a comprehensive financial and budget management platform designed to help individuals gain better control over their finances. It offers a range of features that help businesses track cash flow, manage their expenses, and enhance financial performance through automation and actionable insights. Additionally, it provides a strategic edge by monitoring users’ net worth and credit standing.

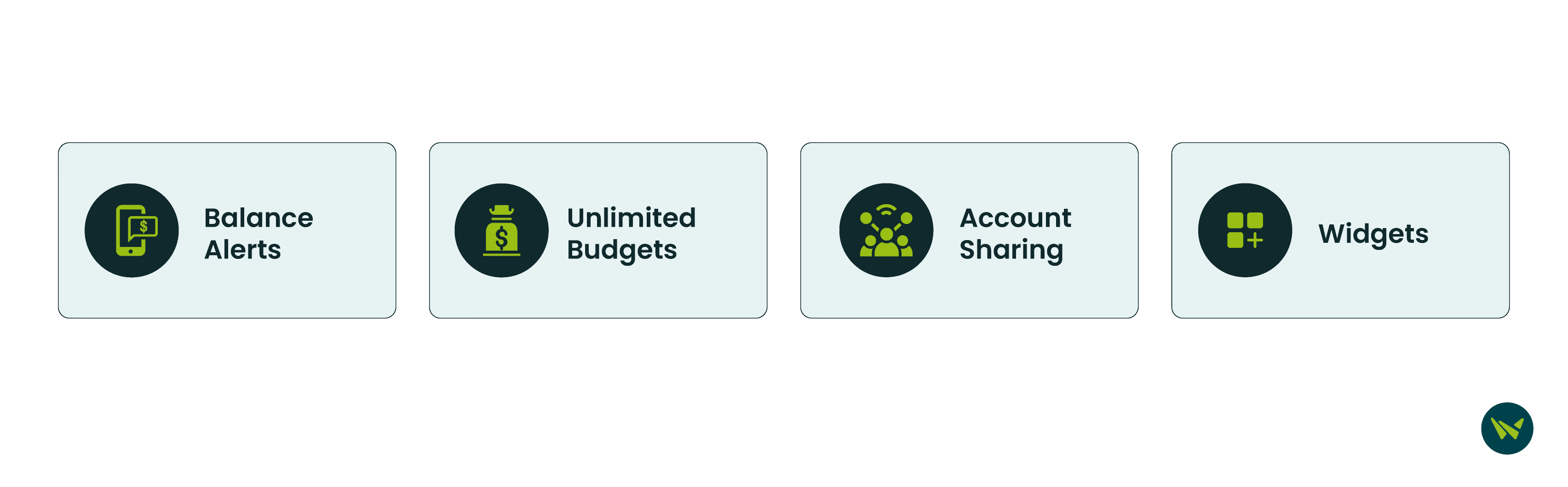

Standout Features

- Balance Alerts: Offers businesses with real-time balance updates providing a unified view of credit spending, essential for accurate forecasting and liquidity management

- Unlimited Budgets: Financial teams can set unlimited budget categories according to their needs, making it ideal for tracking departmental or project-based expenses

- Account Sharing: Allows users to easily share their Rocket Money account with family members, friends, or financial advisors to improve transparency and collaboration on budgeting

- Widgets: Exclusively available on feature brings your finances directly to your home screen for quick, at-a-glance insights of upcoming bills and payments, recent transactions, and balances to avoid over-spending

Pros And Cons

Pros

- Tracks monthly subscriptions to reduce unnecessary service charges

- Offers valuable insights into overall personal spending habits

- Alerts users to forgotten or unused subscription payments

Cons

- Limited support for customized financial goal setting

- No traditional reports reduce detailed financial visibility

Mint by Intuit allows users to link accounts, track spending, categorize expenses, monitor credit scores, and view their net worth. These capabilities are now part of Credit Karma, preserving its core budgeting tools while adding advanced credit services and providing proactive financial insights. It offers a range of advantages that enhance financial management through a unified and intelligent platform.

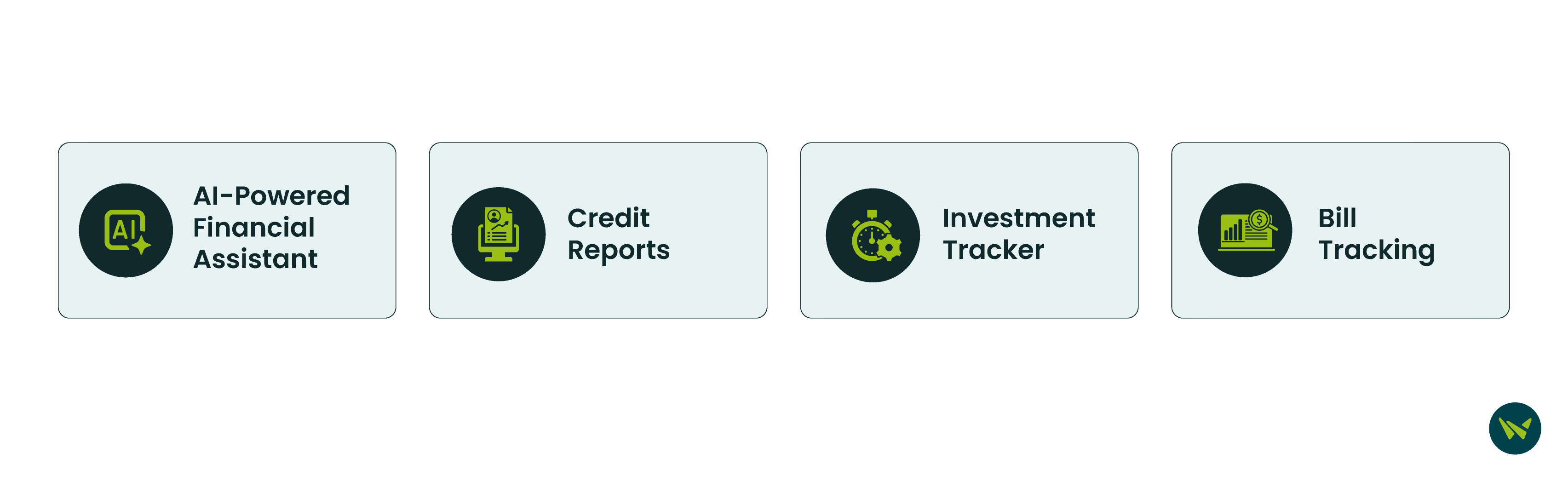

Standout Features

- AI-Powered Financial Assistant: Offers a GenAI-powered assistant that provides personalized, real-time financial guidance such as optimized credit usage and cash flow suggestions, helping businesses handle complex financial decisions with ease

- Credit Reports: Users can view and monitor their TransUnion® and Equifax®credit reports at no cost, updated frequently while offering access to view credit cards and loan options

- Investment Tracker: The platform’s investment tracking tools provide a clear view of your investment accounts. You can compare your portfolio to market benchmarks, monitor account balances, boost your long-term savings, and work toward increasing your net worth

- Bill Tracking: Mint lets financial teams set up bill reminders and sends alerts when due-dates are near, or the account balance is low, helping them avoid missed payments and overdraft fees

Pros And Cons

Pros

- Easy export of financial data into Excel

- Built-in graphics provide quick financial overviews

- Long-term reliability with consistent annual improvements

Cons

- Linked bank accounts occasionally become disconnected unexpectedly

- Budgeting errors between categories can disrupt planned financial tracking

Truebill software offers businesses a free and premium plan. Here’s the breakdown:

- Free Plan: Free forever

- Premium Plan: $6 to $12/month after 7-day free trial

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

Mint software offers a list of features, including credit scores and reports, as well as identity monitoring, all of which are completely free for all users.

Both Truebill and Mint offer powerful financial management tools, but they cater to slightly different user needs. Truebill excels in subscription tracking, spending insights, and account linking, while Mint surpasses it in credit monitoring and long-term financial planning.

Ultimately, the best budgeting software for you depends on your specific financial needs and requirements. Choosing either Truebill or Mint can be a valuable first step toward achieving your financial goals.