Many people today unknowingly pay for subscriptions they no longer use. And this issue is more common than you might think:

A 2022 study by C+R Research found that 42% of Americans still pay for unused subscriptions. Interestingly, Gen Z is much more likely to forget than Boomers. Sometimes, they don't remember to cancel free trials that automatically renew into paid plans. In other cases, old services continue charging in the background without their knowledge. Over time, these small monthly fees can pile up and affect your budget.

Therefore, to tackle this problem, apps like Truebill and Billshark offer solutions—but with different approaches.

Truebill is built for users seeking long-term financial control, offering automation and budgeting tools to track and manage subscriptions. On the other hand, Billshark prioritizes quick savings by negotiating bills and canceling unwanted subscriptions on the user’s behalf.

This guide breaks down both tools across key features, pricing, and services, helping you decide which one aligns better with your financial management style.

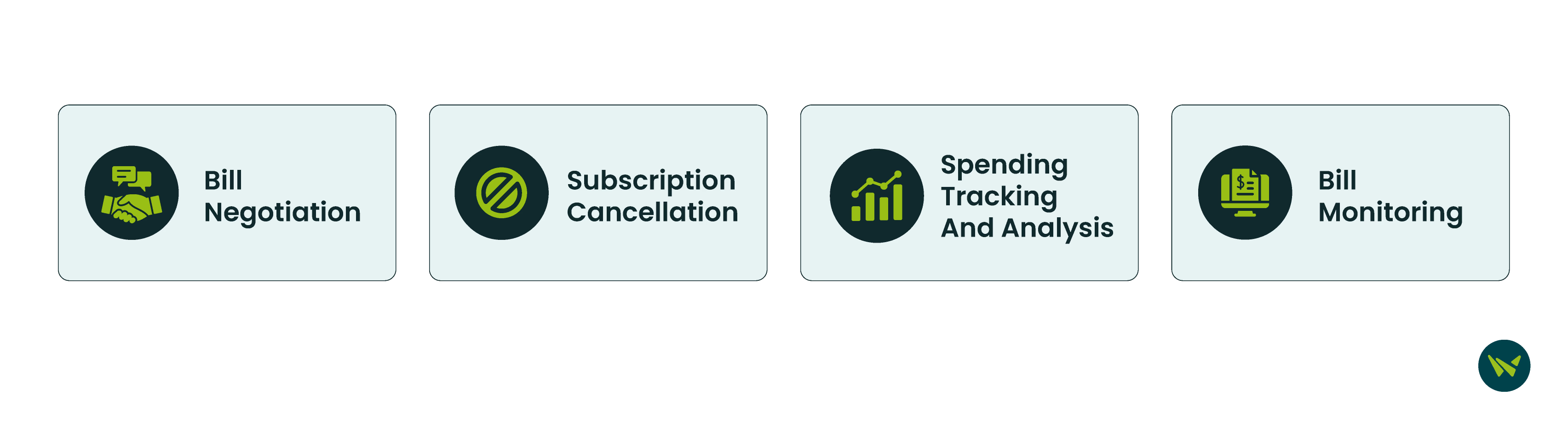

Features | Truebill | Billshark |

Bill Negotiation | Available as part of a broader finance app; negotiation fee is 35–60% of first-year savings | Focused solely on negotiation; charges a flat 40% of total savings over 24 months |

Subscription Cancellation | Auto-detects subscriptions; Premium users can cancel in-app at no extra cost | Manual process; you upload the subscription, and they cancel it for $9/service |

Spending Timing And Analysis | Offers spending breakdown, budgeting goals, alerts, and safe-to-spend estimates | Currently not available |

Bill Monitoring | Tracks all bills and subscriptions; provides alerts, due dates, and a full dashboard | Only monitors bills it negotiates; re-negotiates automatically upon expiration |

Pricing | Free basic plan; Premium $6–$12/month (user-chosen); 30–60% bill negotiation fee | No subscription; charges 40% of bill savings and $9/subscription cancellation |

Truebill software (now rebranded as Rocket Money) is a personal finance app designed to help users take control of their subscriptions, track spending, and save money. The software connects seamlessly with your bank accounts and credit cards allowing automatic recurring payments identification, like streaming services, gym memberships, or forgotten free trials, and send prompt alerts.

The app’s effectiveness gained national recognition when it received the 2022 ‘Savings Champion Award’ for its outstanding impact during America Saves Week. This recognition is one of the reasons why over 5 million people trust the platform today.

This system is useful for households with shared expenses, young adults managing their first budgets, and anyone who signs up for multiple free trials.

- Budgeting Tools: These tools enable users to set up and manage budgets for specific categories or financial goals. It tracks spending against these budgets and sends notifications if you’re at risk of overspending, helping you stay on track with your financial goals

- Smart Savings: Truebill’s ‘Financial Goals’ feature (formerly called Smart Savings) can help you save money. It automatically moves small amounts from your checking account into a safe savings account with an FDIC-insured bank

- Automated Subscription Cancellations: This system can automatically cancel unwanted subscriptions for you with a single click, saving you the hassle of contacting service providers yourself

Pros

- Helps identify and cancel unwanted subscriptions, potentially saving users money

- Aggregates all accounts/cards in one place for easier budgeting

- Notifies users of charges, helping catch unauthorized or forgotten expenses

Cons

- Some users find its customer support slow and unresponsive

- Frequent re-logins required for linked bank accounts, which can be annoying

Billshark is a financial software and service designed to help users save money by negotiating lower bills on their behalf. According to NBC Nightly News, one user claimed to have saved more than $2,000 through Billshark’s bill negotiation service.

It primarily targets recurring expenses such as cable and internet services, mobile phone plans, insurance premiums, and other subscription-based services. Users provide Billshark with details about their current bills, and the company’s team of negotiators then contacts service providers to secure better rates or discounts. If successful, Billshark takes a percentage of the savings as a fee, meaning users only pay when the service delivers results.

This can be especially useful for users who are too busy, dislike haggling, or aren’t confident in their negotiation skills.

- Rewards Program: This is a customer loyalty program that lets users earn ‘Reward Dollars’ every time they submit a bill for negotiation. These include practical discounts like 20% off car maintenance, small treats like a complimentary coffee, or even dining deals like buy-one-get-one-free meals at neighborhood restaurants

- Service Outage Assistance: When your internet, TV, or phone service goes down due to provider outages (like Xfinity, Verizon, or AT&T), Billshark's team—known as ‘Sharks’—can request service credits on your behalf and even negotiate better monthly rates once service is restored. They streamline the process, so you don't have to chase credits or talk to multiple departments

Pros

- Alerts customers when it’s time to renegotiate

- Dedicated ‘Sharks’ assigned to customers for ongoing support

- Customers receive timely text/phone updates on negotiation progress

Cons

- Sometimes the system charges users for savings they negotiated themselves

- Many users report that its savings promises are misleading or inaccurate

Truebill provides a free plan with basic budgeting and subscription tracking tools. If you want access to advanced features, you can upgrade to Truebill Premium.

- Premium Plan: Between $6 and $12/month

- Free Trial: 7 days

- Bill Negotiation Fee: 30%–60% of first year’s savings (you choose the percentage when submitting)

Billshark takes a slightly different approach with a straightforward pricing model. That include:

- Negotiation Fee: 40% of total savings (over a 24-month period)

- Subscription Cancellation Fee: $9/cancellation

Both Truebill and Billshark only collect payment if they successfully reduce your bills, meaning no savings equals no cost.

Disclaimer: The pricing is subject to change.

With 2 wins and 2 ties, Truebill emerges as the more versatile and automated personal finance app.

It gives you a complete financial overview, helps you track spending, and makes it easier to cancel subscriptions—all from one dashboard. It's a great pick if you’re looking for convenience, automation, and control over your money. Billshark, on the other hand, is best if you just want a no-hassle way to lower your bills. Its automatic re-negotiation feature can keep saving you money long after the first discount.