Cardata automates accurate, tax‑free mileage reimbursement for mobile workforces. It saves employer costs and ensures IRS compliance. While it requires personal vehicle insurance compliance, it delivers award‑winning support, scalable mobile tracking, and automated direct payments for user’s ease and seamless functionality.

Cardata Specifications

Employee Information Management

Recruitment and Applicant Tracking

Performance Management

Attendance and Time Tracking

What Is Cardata?

Cardata software captures business mileage via GPS, calculates IRS‑compliant reimbursements down to the cent, and pays employees automatically. The software also provides a command‑center dashboard with real‑time visibility into mileage, cost, and compliance data in a single place providing ease of use for users in one singular dashboard. It verifies driver insurance and supports multiple reimbursement models (FAVR, TFCA, CPM) tailored to regional cost factors.

Cardata Pricing

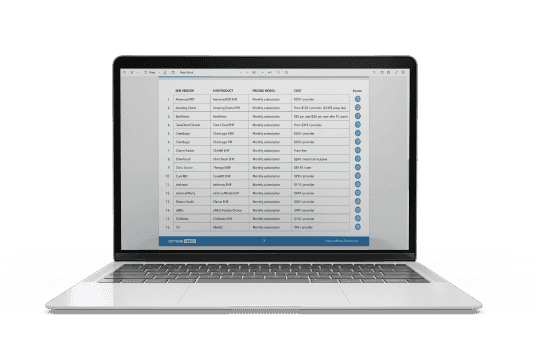

Cardata Integrations

Who Is Cardata For?

Cardata is suitable for the following sectors:

- Finance And Management

- Human Resources (HR)

- Procurement And Fleet Oversight

Is Cardata Right For You?

Cardata software is suitable for businesses aiming to replace costly fleet programs with tax‑free reimbursement models based on actual mileage and local cost data. It integrates with SAP Concur and combines mobile tracking, custom reporting, and direct deposit to streamline administration and ensure audit‑proof IRS compliance. The software’ dedicated support and scalable tools avoid manual billing, reduce risk, and enable workforce autonomy without sacrificing oversight.

Still uncertain if Cardata is right for you? Contact our customer helpline at (661) 384-7070 for further guidance.

Cardata Features

Cardata supports centralized approval for monthly mileage, configurable cost budgets, and real-time compliance monitoring from a unified HR dashboard. It consolidates multiple reimbursement models (FAVR, TFCA, CPM) under one executive view while eliminating manual paperwork.

The software generates customizable data summaries and interactive dashboards to monitor program cost, participation, and mileage trends. It integrates AI alerts to flag compliance risks immediately and enables HR to schedule timely automated report delivery to stakeholders.

The platform confirms valid auto insurance for each driver by uploading policy documents and monitoring renewal status. Cardata flags infractions such as expired or non-standard coverage before payroll processing. It links mandated safety training to policy checks to maintain HR oversight.

The system captures IRS‑acceptable mileage using GPS, even during mobile service interruptions, by detecting real or manual trips tied to work schedules. Cardata auto-tags and submits trips for HR review at month-end without manual logs.