TADÁ centralizes payroll, HR, treasury, and accounting for Mexican businesses in one configurable platform. While limited to Spanish-language use and local regulations, users note its intuitive interface, automation speed, and direct connections with IMSS and INFONAVIT. These features simplify administration and support full legal compliance within Mexico’s payroll ecosystem.

TADÁ Specifications

Employee Information Management

Recruitment And Applicant Tracking

Performance Management

Attendance And Time Tracking

What Is TADÁ?

TADÁ is a cloud-based payroll and HR management system tailored for businesses operating in Mexico. It automates payroll processing, including tax and benefits deductions, to meet local compliance requirements. The platform also features customizable scheduling and a self-service portal, helping reduce administrative workload and improve employee access to key information without relying on HR intervention.

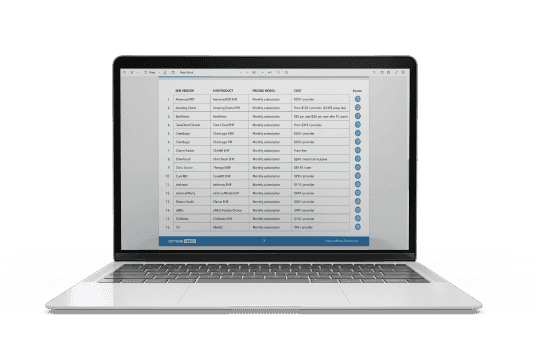

TADÁ Pricing

TADÁ Integrations

Who Is TADÁ For?

TADÁ software is ideal for a wide range of industries and sectors in Mexico, particularly those with complex labor structures, including:

- Automotive

- Manufacturing

- Energy and petroleum

- Construction and infrastructure

- Tourism

- Transportation and logistics

- Financial services and fintech

Is TADÁ Right For You?

TADÁ is especially well-suited for mid to large Mexican companies with complex payroll structures and strict compliance needs. Its standout offering, the optional TADÁ Assistance service, lets in-house specialists fully manage payroll operations. This model appeals to teams lacking internal payroll capacity but needing precision and legal alignment. It’s a practical fit for businesses aiming to outsource complexity without losing oversight.

Still unsure if TADÁ is the right fit for you? Connect with our customer support staff at (661) 384-7070 for further guidance.

TADÁ Features

TADÁ features real-time payroll processing that handles bonuses, severance, pensions, and multiple pay periods. This reduces manual intervention and ensures consistent accuracy across all employee types, helping companies meet legal requirements while saving significant time on each pay cycle.

The platform connects directly with Mexican institutions like IMSS and INFONAVIT, enabling users to register or remove employees and report salary changes without leaving the system. This centralized workflow helps businesses avoid regulatory delays and eliminate double-entry errors across systems.

For companies lacking dedicated payroll personnel, TADÁ offers a managed service model in which specialists oversee the full payroll process—from data validation to tax filing. This reduces risk and provides assurance that payroll tasks are executed accurately and in compliance with local laws.

Businesses can configure payroll frequencies—daily, weekly, biweekly, or monthly—based on operational needs. Combined with tailored payment concepts and variable shift handling, this flexibility supports unique labor arrangements common in sectors like manufacturing, logistics, and agriculture.

Employees access their pay stubs, personal data, and tax documents through a secure portal without needing HR support. This improves transparency, cuts down on routine information requests, and gives staff immediate visibility into their payroll history and employment records.