There are numerous payroll software options out there claiming to be the best at simplifying cross-border payments. While none can be declared the absolute ‘best,’ it’s true that some excel in certain areas due to their unique offerings and capabilities.

In this guide, we have explained some of the best payroll solutions for international employees that your company can use to ensure smooth payroll runs, streamline human resources (HR) tasks, and expand its global presence.

These are our top picks for the best payroll software for international employees:

Software | Best For | Main Features |

Oyster | Businesses seeking a simple, currency-flexible solution to manage payroll across 28+ countries | Multi-currency payments across 28+ countries, detailed reports, and compliance reporting |

Rippling | Companies that want a deeply integrated global payroll and benefits in one unified system | Automated pay calculations and reimbursements along with benefits administration |

Papaya Global | Enterprises managing payroll in multiple countries with a focus on automation and compliance | Payroll management in 160+ countries, APIs, and AI-powered compliance |

ADP Vantage HCM | Large enterprises needing scalable, localized payroll with global reach and HCM integration | Self-service portals and seamless integration with existing HCM platforms |

Remote | Companies seeking a unified platform for global payroll, benefits, and compliance | Localized payroll compliance in 100+ countries, in-country legal experts, and integrated benefits |

Gusto | Paying international contractors quickly and easily without complex infrastructure | Contractor payments in local currency, automated recurring payments, and global hiring |

Deel | Businesses scaling global teams with full compliance and compensation transparency | In-country payroll and compliance support in 130+ countries, centralized compensation planning, and self-service portals |

Multiplier | Businesses needing reliable, locally compliant payroll execution across borders | Global tax automation, local payroll experts with language support, and auto-adjustment for time off and expenses |

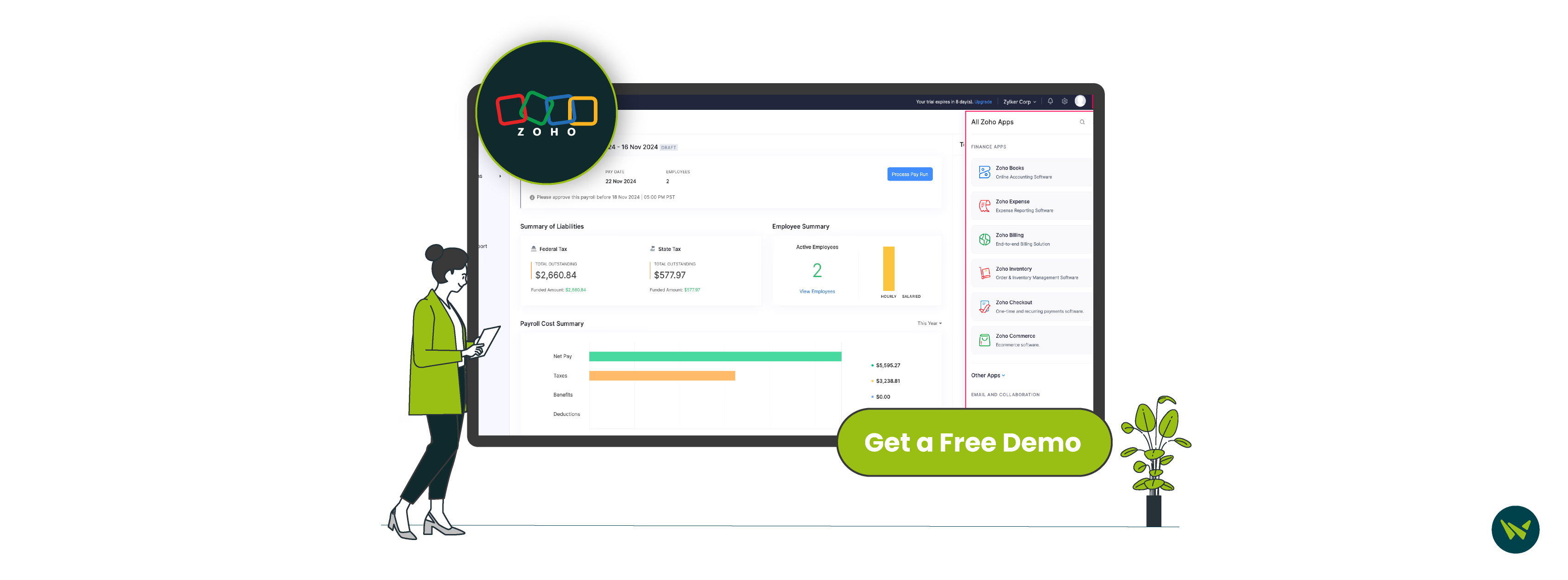

Zoho Payroll | Streamlining payroll for businesses in the US, UAE, KSA, and India | Automated salary calculations, compliance with federal and regional laws, and unified employee data management |

CloudPay | Large enterprises managing payroll at scale with high accuracy and control | Payroll support in 130+ countries, HCM system integration, and multi-step data validation by experts |

Oyster is a global payroll software and service provider that allows businesses to run multi-country payroll in 28+ countries. Not only that, but it also supports multi-currency payments, allowing employers to pay their global workforce in their local currency, which reduces complexity and confusion. Users can also access detailed reports, payslips, and invoices, enabling them to simplify workflows and speed up decision making.

Additionally, businesses can always get assistance from Oyster’s experts when they need help with compliance and regulations in specific countries. This ensures companies are always compliant with local laws and avoid legal complications.

Pros

- Automation features are helpful in avoiding errors in payroll and compliance

- The process of payroll approval and expense management is easy for international remote teams

- Customer support is responsive and has proper knowledge of the platform

Cons

- Invoicing features may be a bit complex for small businesses

- The implementation process can be a bit difficult

Rippling is a comprehensive human resources (HR) software that offers powerful international payroll capabilities. It simplifies paying global employees with features for automatic pay calculations, deductions, and reimbursements.

The platform calculates payroll taxes and benefits, and remits payroll taxes as per an employee’s local, national, and industry-specific requirements. Moreover, Rippling’s global payroll features are integrated with benefits administration, enabling businesses to automate contributions and deductions for publicly funded programs.

Pros

- Payroll features are customizable and easily manageable

- Running global payroll and paying contractors can be done from the same place

- Employers can keep track of expenses using numerous payroll metrics

Cons

- Changing payroll configuration can take some time for new users

- Customer support response time could be improved

Papaya Global is a reliable global payroll solution that allows organizations to manage payroll and payments in more than 160 countries. It offers out-of-the-box APIs and proprietary data connectors to help businesses import all data from their existing human resources information system (HRIS) to the platform. This seamless export eliminates manual data entry, significantly saving time.

The AI-powered tool analyzes salary updates, changes in local compliance regulations, company policies, ensuring payroll cycles are accurate every time. Additionally, Papaya Global’s public accountants are well-versed in local languages, empowering them to navigate and solve complex problems with cultural nuance.

Pros

- Significantly reduces payroll processing time

- Their designated payroll experts are efficient in resolving problems

- Managing payroll for multiple locations is easy and straightforward

Cons

- The sheer number of features and tools may feel overwhelming at the start

- Some bank transactions don’t go through on the first attempt

ADP GlobalView enables organizations to run payroll confidently across 40 countries. When combined with one of its modules, ‘ADP Celergo’, this number can go up to 140 countries, making it a very powerful tool for any business wanting to pay their global workforce.

The platform can be seamlessly integrated with enterprises' human capital management (HCM) solutions with the help of integrations and connectors, making data import and export convenient.

Furthermore, it comes with highly interactive, clear, and intuitive self-service portals that can be localized based on country requirements. This localization allows managers to have their employees access pay information in their native language, giving them a personalized experience and avoiding any confusion due to the language barrier.

Pros

- Pay-related information like payouts, taxes, and salaries are easily accessible

- Payroll features and interfaces are highly customizable, making it suitable for specific, intricate workflows

- Integration with external applications is smooth and helpful

Cons

- Not many suggestions or recommendations offered for tax savings

- Payroll reports can be a bit confusing for some users

Remote is a global payroll solutions provider that aims to consolidate all business aspects like benefits administration, time offs, taxes, and more, using a single dashboard. The platform offers localized payroll compliance support in 100+ countries with the help of in-country experts, allowing businesses to scale their operations globally without worrying about legal penalties and pay inaccuracies.

Moreover, the software enables organizations to choose locally compliant benefits programs that are aligned with employee preferences. This selection helps ensure a satisfied workforce with minimum compliance problems, and a database that’s synced with payroll.

Pros

- Employees can easily access their pay information at any time

- Essential functionalities like payroll and onboarding are centralized, which significantly streamlines processes

- Effectively handles local regulations pertaining to payroll, taxes, and benefits administration

Cons

- Implementing some payroll-related updates can take time

- Off-cycle payments require manual effort

Gusto is a payroll and HR software platform that enables businesses to pay and hire contractors in more than 120 countries. It can be used to pay contractors in their currency without the hassle of managing multiple accounts and using different payment services.

Employers can set up recurring payments, ensuring their teams are accurately compensated on time. This automated payment procedure drastically reduces the time it takes to manage payroll, allowing HR professionals to focus on issues that require their direct attention.

What differentiates Gusto from other payroll providers is its suite of features for hiring employees globally. This capability aligns a company's recruiting and payroll efforts, helping them scale easily without adding complexity to their processes.

Pros

- The payroll history is clearly presented, showing disbursed amounts, payable salaries, and payroll processing dates

- Reliably handles tax forms and direct deposit information

- The process of adding new employees to the payroll system is easy

Cons

- Users cannot get dedicated account representatives for managing international contractors

- The customization options are limited for an enterprise-level business

Deel is a reliable platform that supports organizations in their global expansion by offering assistance with payroll, hiring, and compliance. Businesses get access to professional payroll experts and customer success managers in 130+ countries, helping teams stay compliant with local payroll regulations and minimizing the risk of penalties.

The software comes with an intuitive, self-service interface that reduces HR and administrative tasks while enabling businesses to manage remote teams efficiently. Furthermore, Deel offers a centralized workspace to manage pay bands, ensure pay transparency, and administer compensation review cycles. This helps companies ensure their remote workforce is satisfied with their compensation packages and stays with the business longer, ultimately enhancing the bottom line.

Pros

- Simplifies compliance for payroll and hiring in numerous countries

- Automatically generates local contracts and handles tax documents

- Offers multiple withdrawal options, including PayPal, bank transfer, and Wise

Cons

- Payments can be delayed in some cases

- Integration options with third-party applications are limited

Multiplier is a global human resources platform that allows businesses to manage payroll in 100+ countries. The software calculates multi-country taxes, employee compensation, and benefits to ensure there are no errors. Multiplier has its payroll experts stationed in multiple countries bringing knowledge of local laws and can understand the native language. This helps them to navigate the intricacies of ensuring payroll compliance, ensuring businesses are safe from committing any violations.

Moreover, the software automatically adjusts time off and expenses, ensuring employee working hours are accurately reflected in the payroll. This feature helps businesses ensure their employees are paid according to the work they have put in, ultimately increasing profits.

Pros

- Helps easily manage payroll and payroll-related compliance in multiple countries

- Seamlessly integrates with existing HR platforms and workflows

- Customer support is very helpful in resolving compliance-related issues

Cons

- Its standardized processes don’t offer enough customizability to cater to complex processes

- Their monthly invoicing process can be optimized for more accuracy and efficiency

Zoho Payroll is powerful software that is designed to streamline payroll for businesses in the US, UAE, KSA, and India. The platform automatically calculates employee salaries, ensuring everyone is paid without any delays.

It helps companies stay compliant with local regulations by handling federal and state deductions, managing regional taxes, taking care of employee pensions, and adhering to rules like those for social security and WPS.

Furthermore, Zoho Payroll consolidates employee data related to attendance, leave, and payroll, providing a unified platform that reduces stress for HR professionals and increases process accuracy.

Pros

- Users can effortlessly toggle between salary details, investment declarations, and monthly pay slips

- Generates pay slips for each payroll cycle

- Filing taxes is simple due to its automated tax computing capabilities

Cons

- Requires users to have experience and technical expertise for customizing payroll structures

- No option to run payroll in batches

CloudPay is a cloud-based payroll services provider that handles global payroll on behalf of businesses. The platform supports payroll in more than 130 countries, with in-country payroll experts to ensure every payroll run is compliant with local laws.

It handles payroll and transactions in more than 110 countries, enough for even large organizations to drive their offshore scaling efforts easily. CloudPay integrates with a business’s HCM software, enabling them to seamlessly transfer data without any duplication or errors.

The software also has a unique multi-step data validation process that’s conducted after automatic payroll calculations. The process entails payroll verification by in-house specialists, ensuring reliability and peace of mind for businesses.

Pros

- Enables employees to check shift hours and put in pay rates

- Creates charts and periodic reports using company data

- Manages reimbursements and deductions effectively

Cons

- Customer support can be improved for faster issue resolution

- The platform can be a bit confusing, especially for new users

We focused on choosing software that helps businesses navigate global payroll compliance, supports multiple currencies, and offers flexibility. Here are the main criteria we considered:

When choosing global payroll software, you should focus on features that automate HR processes, reduce manual effort, and ensure compliance. Here are some features to look for:

- Automated tax handling per country

- Multi-language and multi-currency support

- Self-service portals for employees

- Built-in contractor and full-time employee support

- Scalability and local adaptation

- Cross-border payment solutions

- Automatic benefits administration

- Real-time payroll reporting and analytics

A global payroll solution will do more than just run payroll. It will serve as a foundation for your international operations. Here are some benefits you’ll get:

Choosing the right platform for paying your global workforce ultimately depends on your specific requirements, company size, and area of operations. Software like Deel and Gusto offers agility and is ideal for fast-growing businesses and startups. Larger enterprises, however, may find software like Papaya Global and ADP to be more suitable due to their automation features and ease of scalability. If you want assistance with making a decision for your next payroll software, feel free to contact one of our consultants, who can guide you through the decision-making process.