Running a restaurant requires more than great food and service. It also demands strong financial control behind the scenes. From managing vendor payments to handling payroll and tracking daily sales, the right accounting software can make a big difference. These tools automate routine tasks, connect with your point of sale (POS) system, and provide real-time financial data to help you save time and improve profitability.

In this blog, we’ll highlight the top 9 restaurant accounting software of 2025 to help you streamline your operations and keep your bottom line healthy.

Company | Best For | Features | Pricing |

QuickBooks | Streamlined Expense Tracking |

| Starting from $3.50 to $23.50 |

Xero Accounting Solutions | Seamless Integrations |

| Starting from $2.90 to $6.90 |

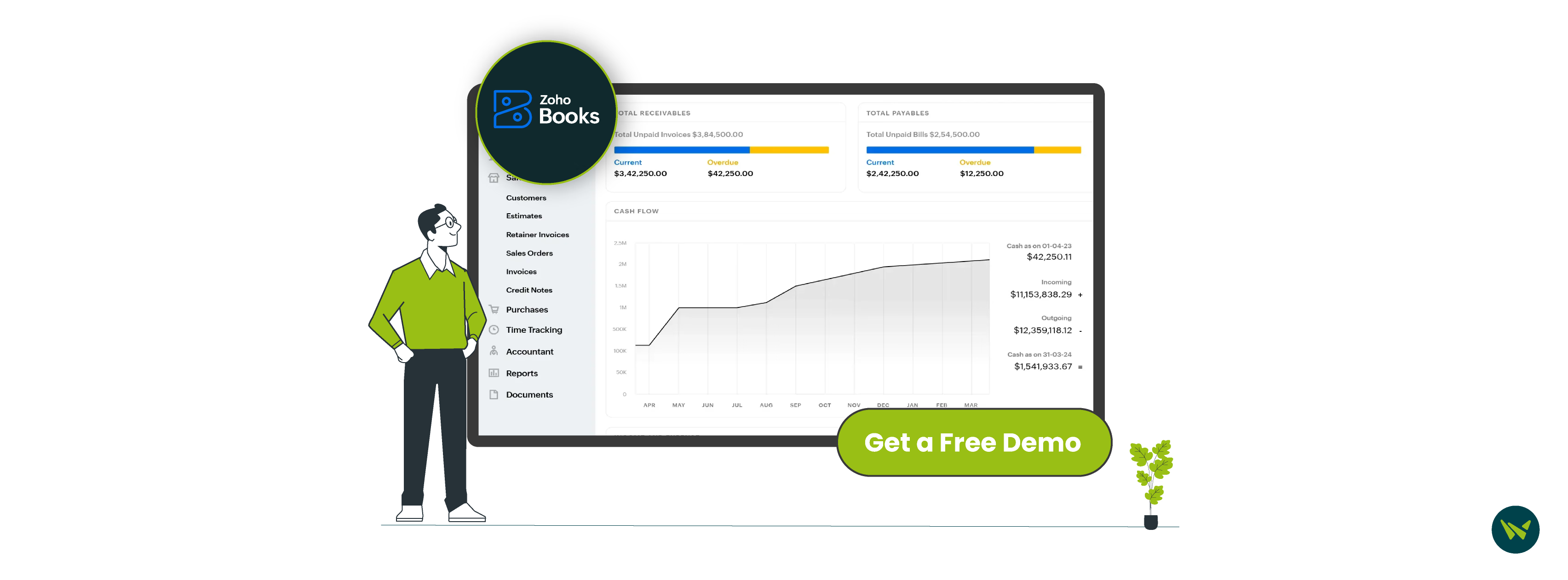

Zoho Books | Automating Small Business Accounting |

| Starting from $20 to $275 |

ZarMoney | Multi-Location Tracking |

|

|

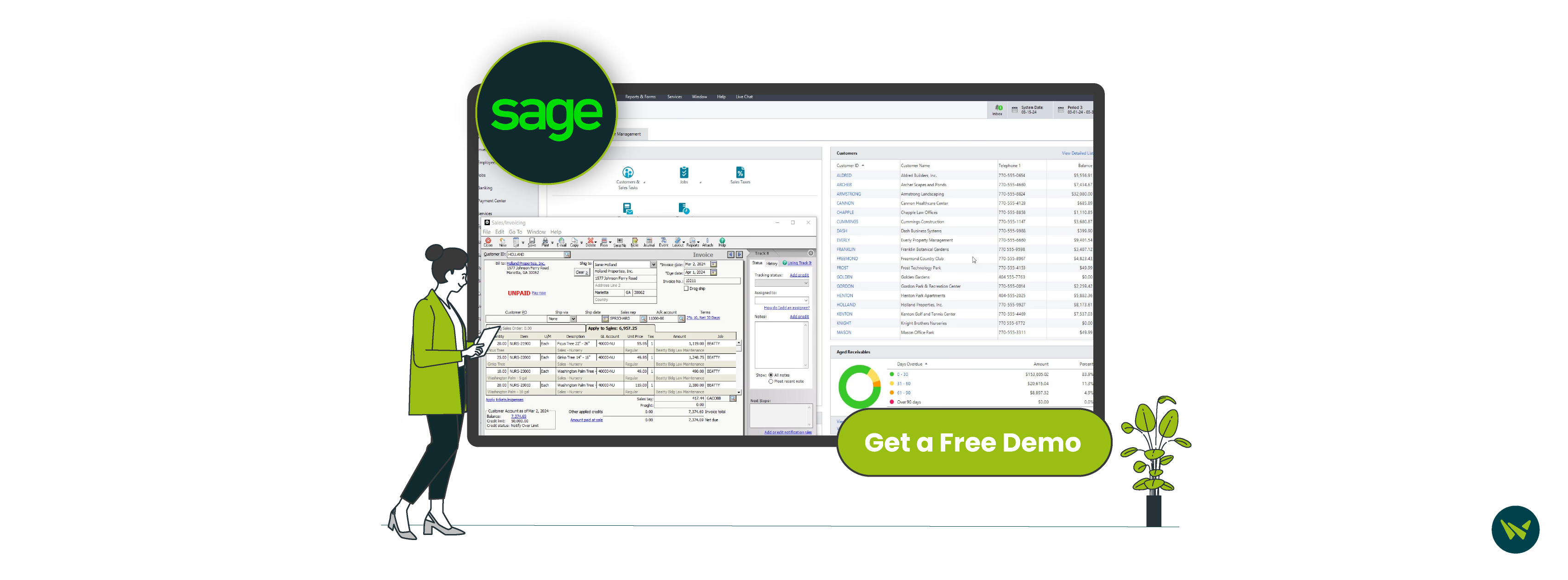

Sage 50 | Offline Financial Management |

| Starting from $61.92 to $177.17 |

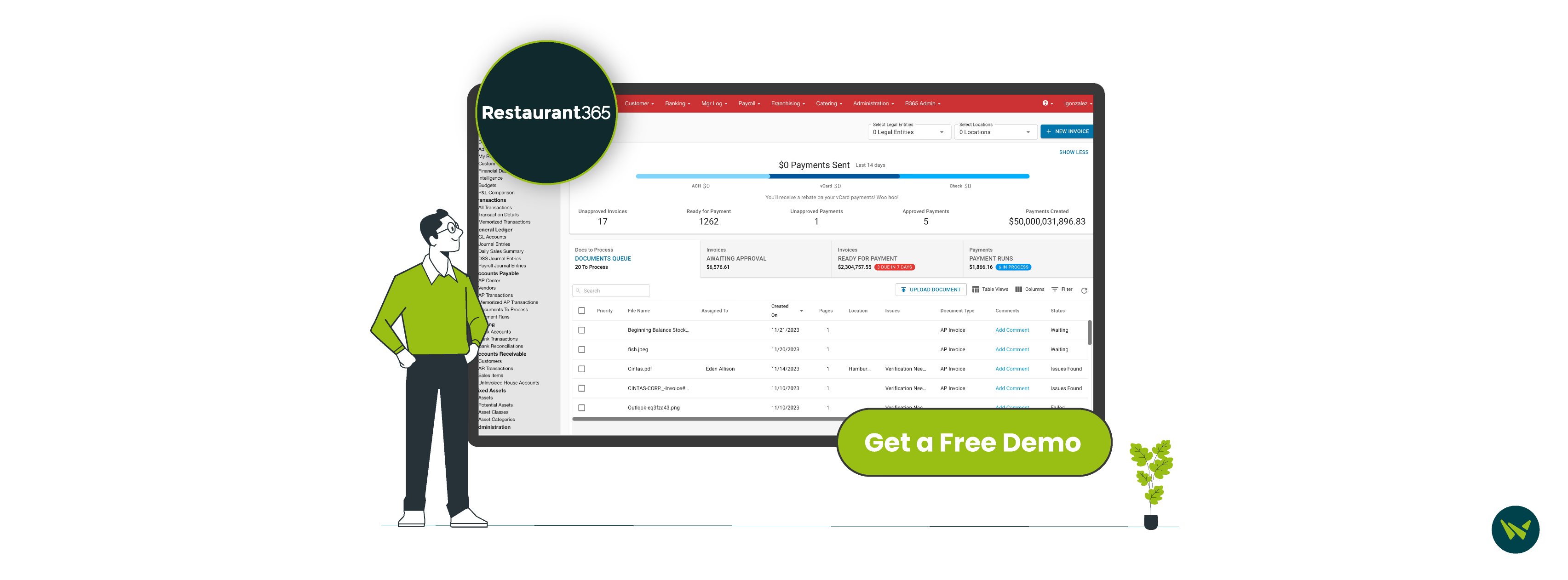

Restaurants365 | Restaurant-Centric Operations |

| Custom |

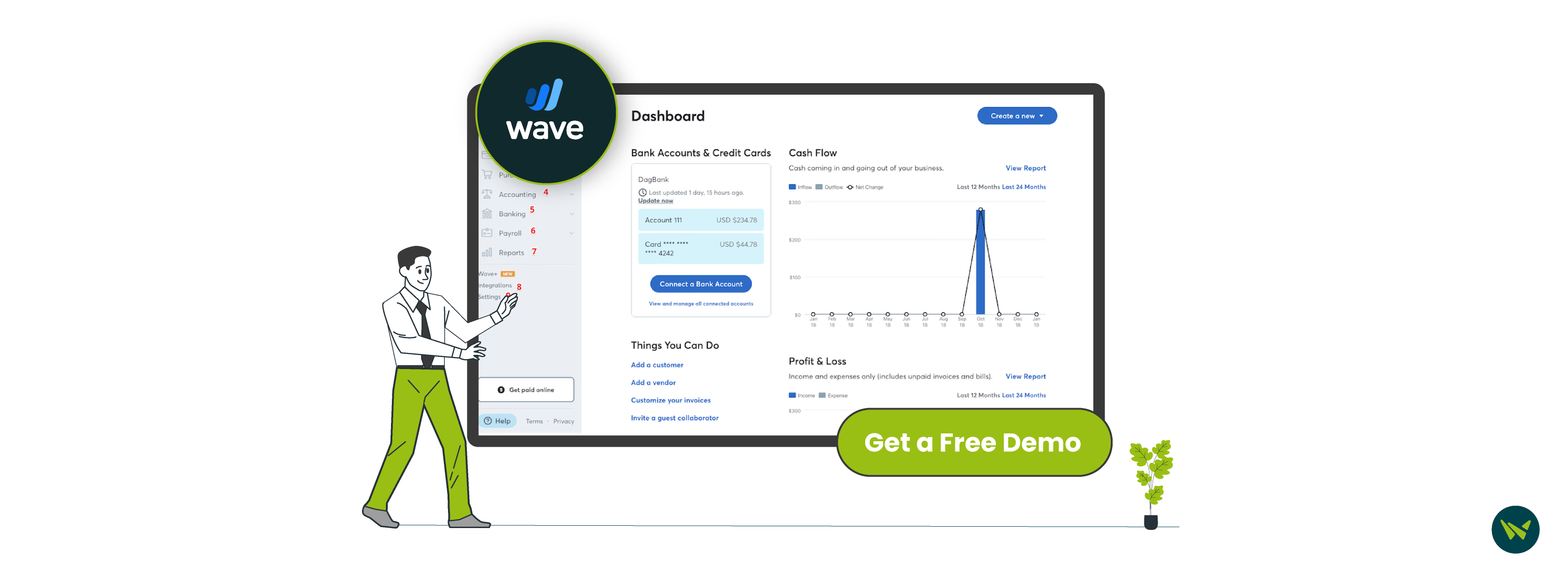

Wave | Small Restaurants |

| Starts at $16/month |

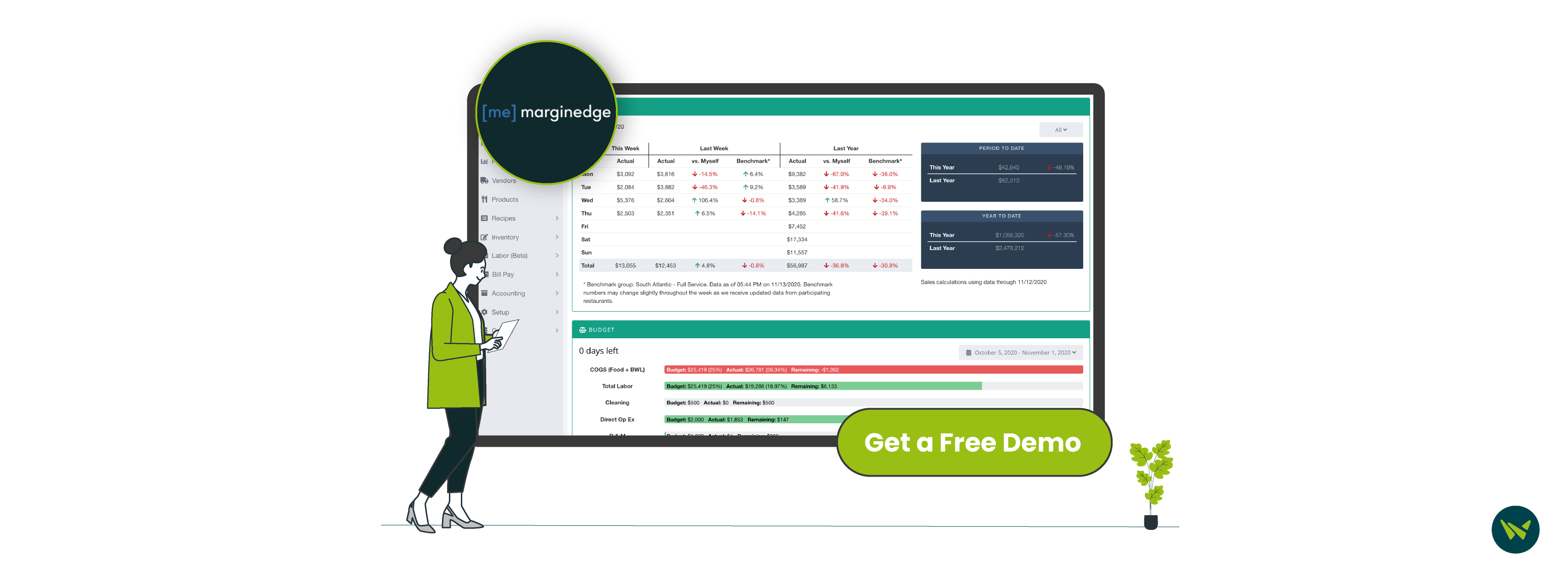

MarginEdge | Restaurant Cost Control |

| Starting from $330 to $480 |

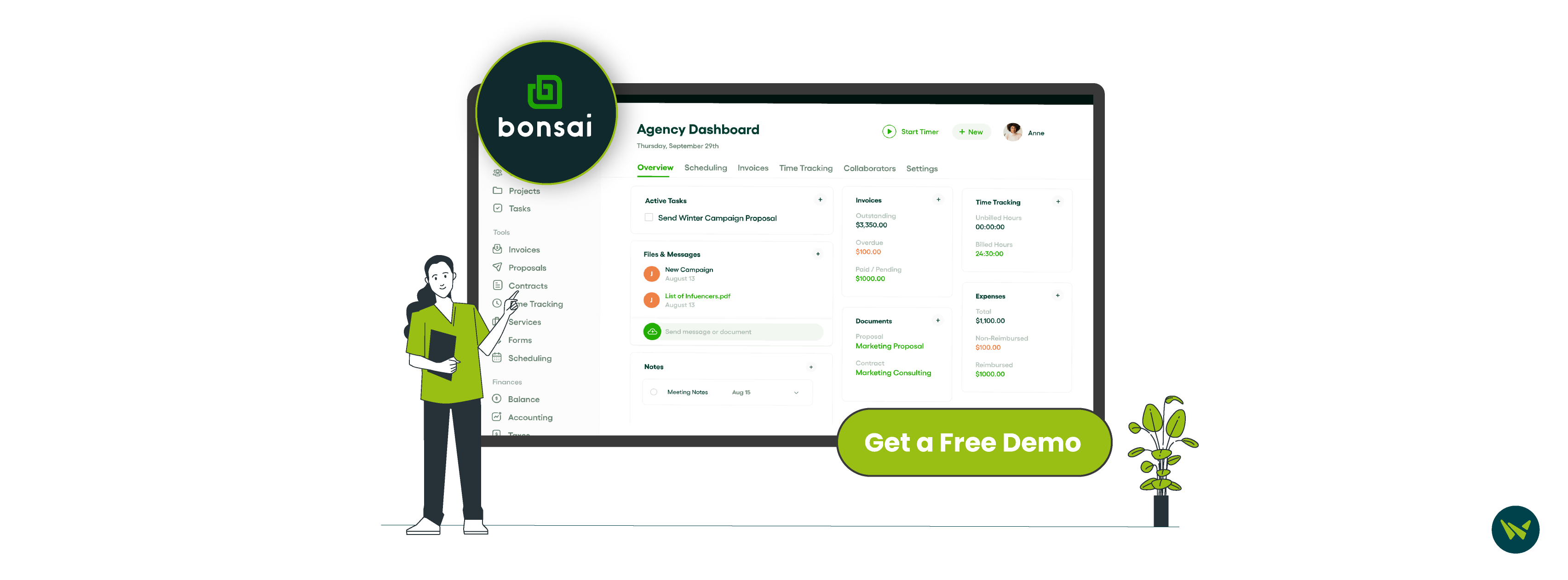

Bonsai Software | Simple Budgeting Needs |

| Starting from $15 to $59 |

QuickBooks is cloud-based accounting software designed to simplify financial management for restaurants. It allows users to monitor transactions, generate customized reports, and track activities such as delivery orders and supply pickups, making it easier to stay on top of day-to-day operations. With its user-friendly interface and 800+ integrations, it supports both small eateries and growing restaurant chains.

Unique Feature

- QuickBooks monitors inventory levels automatically, helping restaurant owners stay stocked by alerting them when supplies run low and tracking all incoming and outgoing items

- It enables real-time performance analysis so users can see how menu changes or operational decisions impact profitability using current financial data

- Users can easily snap and upload receipt photos using the mobile app, which stores all receipts in one place for simple and efficient expense tracking

Pro And Cons

Pros:

- The platform is regularly updated with new and advanced features and tools

- The software integrates with more than 750 business apps, like Gusto and Etsy

- QuickBooks is a great choice for restaurant owners and staff with limited technical experience

Cons:

- Allows only manual revisions in financial reports

- Multiple subscriptions are required when managing more than one business

Pricing

The following are the pricing plans:

- Simple Start - $35/month

- Essentials - $65/month

- Plus - $99/month

- Advanced - $235/month

Disclaimer: The pricing is subject to change.

Xero is a cloud-based accounting software that small restaurants can use to manage their inventory. It offers features such as generating online invoices, bank reconciliation for transaction records, monitoring accounts receivable, and tracking daily finances with an accounting dashboard.

Unique Features

- Xero accounting solution connects with over 21,000 financial institutions worldwide to automatically import bank transactions. This helps streamline bookkeeping by eliminating manual uploads and keeping your records current

- The inventory management system lets users track stock levels in real time, helping prevent overstocking or stockouts. Easily add products to invoices and purchase orders, view top-selling items, and make data-driven decisions with detailed inventory reports

- Xero simplifies expense management by letting users snap receipts, track mileage, and submit claims from anywhere using the ‘Xero Me App’. Managers receive instant alerts for quick approvals, with real-time updates ensuring accurate cash flow and streamlined bookkeeping

Pros And Cons

Pros:

- It offers scalable pricing plans that are not tied to the number of users

- The software easily integrates with 1,000+ applications on Xero app store

- Provides excellent support and regular communication about product updates and new features

Cons:

- Lacks accessible video tutorials during setup, making it tricky and time-consuming for beginners to grasp all features

- It can be difficult to locate certain client contacts, and frequent updates may disrupt familiar workflows, making it frustrating to adjust

Pricing

The following are the pricing plans:

- Starter - $29/month

- Standard - $46/month

- Premium - $69/month

Disclaimer: The pricing is subject to change.

Zoho Books is a cloud-based accounting software designed to simplify small business finances through powerful automation. Its built-in tools reduce manual, error-prone tasks. At the same time, its unique scripting language allows users to create custom functions tailored to their needs. Modules like Zoho Invoice make the software a smart choice for budget-conscious restaurant owners aiming to save time and boost accuracy.

Unique Features

- Easy to create, customize, and manage quotes in just a few clicks. Users can generate quotes instantly using saved contact and item details, personalize them with branded templates, and even secure them with digital signatures via Zoho Sign

- It simplifies the purchasing process with intuitive tools that let you create and customize purchase orders quickly. Track item details and vendor pricing to avoid discrepancies and attach relevant files for added context. Instantly convert purchase orders into bills with one click to streamline your workflow

- Zoho Books offers powerful financial reports and visual dashboards to help businesses track performance and make informed decisions. Generate key reports anytime, customize with filters and tags

Pros And Cons

Pros:

- Offers extensive features with advanced accounting functionality suitable for small businesses

- Provides responsive customer support

- Supports online payments and customizable options like automated client payment reminders

Cons:

- Lacks a simple way to settle vendor and customer ledgers with one journal entry

- Limited payroll features for complex international tax scenarios

Pricing

The following are the pricing plans:

- Free - Free

- Standard - $20/org/month

- Professional - $50/org/month

- Premium - $70/org/month

- Elite - $150/org/month

- Ultimate - $275/org/month

Disclaimer: The pricing is subject to change.

ZarMoney is a cloud-based software designed to streamline business finances through its comprehensive financial management features. Easily manage global and local inventory, automate sales tax calculations, and receive online payments while improving the cash flow. Small business owners running restaurants can benefit from real-time tracking, customizable reporting, and simplified expense management.

Unique Feature

- The software streamlines accounting by letting users compare reported transactions with actual bank statements. Generate essential reports like balance sheets, cash flow statements, and tailored earnings summaries effortlessly

- ZarMoney offers over 40 built-in and 1,000+ customizable reports, allowing businesses to monitor finances with clarity

- It enables real-time inventory control across multiple locations with its cloud-powered split-view dashboard. Businesses can track stock levels, monitor item histories, forecast demand, and streamline departments from procurement to delivery

Pros And Cons

Pros:

- Enables fast company and inventory setup

- Offers payment alerts to manage overdue invoices efficiently

- User-friendly with limited access controls for sales teams

Cons:

- There is no mass delete data option

- Lacks simplified invoice summary view

Pricing

The following are the pricing plans:

- Small Business - $20/month

- Enterprise - $350/month

Disclaimer: The pricing is subject to change.

Sage 50 is a desktop accounting software with cloud connectivity that automates administrative tasks such as invoicing, payments, and inventory management. Its features include a cash flow manager, bank reconciliation, job costing, payroll, and reporting. It is ideal for small to medium-sized businesses (SMBs) that can also meet the specific needs of restaurants.

Unique Features

- Sage 50 offers over 150 ready-made reports to help businesses make informed decisions with ease. Access one-click reports covering everything from receivables and payroll to inventory and job costs

- It offers inventory management with real-time tracking of stock levels, costs, and purchase orders. Customize units of measure, build item assemblies, and manage serialized inventory

- The software simplifies cash flow management with real-time snapshots of income and expenses through its Cash Flow Manager. Easily project future cash positions, customize views by date or transaction type, and streamline invoicing with batch sends

Pros And Cons

Pros:

- Provides clear visibility into financial health, aiding strategic focus

- Makes reviewing transactions and running reports easy and flexible

- Includes tutorials and guides for quick user onboarding

Cons:

- Syncing limitations prevent multi-user access during key tasks like reconciliation

- Backups require all users to log out, disrupting workflow

Pricing

The following are the pricing plans:

- Pro Accounting - $61.92/user/month

- Premium Accounting - $103.92/user/month

- Quantum Accounting - $177.17/user/month

Disclaimer: The pricing is subject to change.

Restaurant365 is a cloud-based restaurant management software that integrates accounting, inventory, payroll, and operations management into a single system. Designed specifically for restaurants, it offers real-time data insights, automates routine tasks, and streamlines workflows across multiple locations. Trusted by 40,000 restaurants, it helps businesses operate more efficiently and make data-driven decisions.

Unique Features

- The software simplifies financial planning by allowing accurate budgeting across locations and delivering real-time forecasts using integrated point of sale (POS), labor, and inventory data

- Restaurant365 helps reduce food costs by automating inventory tracking, recipe costing, and item transfers. Use mobile tools for real-time inventory counts, reconcile vendor invoices easily, and optimize margins with actionable reports on actual vs. theoretical costs

- The ‘Logbook’ feature keeps managers and teams aligned with a centralized hub for documenting shift notes, assigning tasks, and tracking performance. Easily communicate critical updates, automate task lists, and surface high-priority items with quick filters

Pros And Cons

Pros:

- Enables site-level teams to access real-time financial reports

- Automatically batches food deliveries into accounts payable and tracks all purchased products

- Allows document uploads as backup for every transaction

Cons:

- Bank reconciliation can be time-consuming

- The ‘Scheduler’ feature struggles with multi-location employee shifts

Pricing

The following are the pricing tiers:

- Accounting - Custom

- Inventory And Purchasing - Custom

- Workforce Management – Custom

Wave Accounting platform is a cloud-based solution solely designed for small businesses, including restaurants. It offers a range of features, including accounting, payroll invoicing, and online payments. Wave’s extensive features help streamline operations, simplify bookkeeping, and support efficient financial management.

Unique Features

- Wave’s double-entry accounting ensures accurate records that are easily transferable during tax season. Accountants can securely retrieve essential reports and streamline year-end preparation and saving business owners' valuable time

- The expense tracking and business reporting tools let users categorize spending, add notes, and compare costs like menus and food supplies to uncover savings opportunities

- It offers online payment options to help businesses maintain a steady revenue flow. Users can connect their bank accounts for automatic transaction reconciliation, simplifying financial management and saving time

Pros And Cons

Pros:

- The free version includes essential tools for accurate accounting

- Strong control over payables, payments, and expenses for efficient management

- Automates billing and invoicing to save time

Cons:

- Reports are limited to annual views, making monthly financial tracking difficult

- Receipt uploads are fully manual, which becomes tedious over time

Pricing

The following are the pricing plans:

- Starter Plan - Free

- Pro Plan - $16/month

Disclaimer: The pricing is subject to change.

MarginEdge is a cloud-based restaurant management platform designed to streamline back-office tasks for restaurants. It automates invoice processing, tracks food costs in real-time, and integrates with over 60 point of sale (POS) systems, making it ideal for eateries seeking to eliminate paperwork and gain actionable financial insights.

Unique Features

- It simplifies invoice handling by automating the entire process. Restaurants can upload invoices via scan, email, photo, or electronic data interchange (EDI). The software updates prices, captures handwritten details, syncs with accounting tools, and provides real-time reports

- MarginEdge gives restaurant operators real-time visibility into costs with daily profit and loss reports, budget tracking, and automatic price alerts. Combine daily sales and invoice data to calculate prime costs in real time and track budget status within 48 hours

- The software handles inventory control with smart sheets that automatically update product prices and real-time tracking for precise inventory levels. Effortlessly manage ordering, reduce waste through detailed variance reports, and transfer items or recipes across locations

Pros And Cons

Pros:

- Automatic invoice uploads save significant time

- Simplifies menu item costing and tracking

- Helps pinpoint losses by tracking the cost of goods, labor, and product prices daily

Cons:

- Price alert setup can be tedious due to lack of bulk selection options

- Delays in invoice posting may hinder timely category corrections

Pricing

The following are the pricing plans:

- MarginEdge - $330/month/location

- MarginEdge + Freepour - $480/month/location

Disclaimer: The pricing is subject to change.

Bonsai software is an all-in-one cloud-based accounting software that consolidates client management, project tracking, invoicing, and bookkeeping into a single, user-friendly interface. Bonsai streamlines operations by automating workflows, improving financial visibility, and supporting seamless collaboration for teams of any size. Its affordability and mobile accessibility make it viable for small eateries or food trucks needing basic financial oversight.

Unique Features

- Bonsai streamlines billing by allowing businesses to create branded invoices in seconds, set up recurring payments, and automatically apply late fees. Clients can pay easily via card, while the system handles read receipts and payment reminders

- It helps businesses stay financially organized with automated expense tracking and tax estimates. Users can connect bank accounts for automatic categorization, download Schedule C reports, and receive timely reminders to make it easier to maximize deductions and stay ahead of tax deadlines

- The software allows users to plan, monitor, and stay within budget across all projects. They can set fee or time-based budgets, track billable and non-billable hours, and assign cost rates per team member

Pros And Cons

Pros:

- Generates reports in minutes instead of hours, saving significant time

- Provides real-time visibility into budgets and business financials with a single click

- Dramatically reduces proposal and invoice creation time with auto-invoicing

Cons:

- Auto-invoicing can trigger without final review, leading to unapproved client invoices

- Payment processing speed can be slower than expected

Pricing

The following are the pricing plans:

- Basic - $15/user/month

- Essentials - $25/user/month

- Premium - $39/user/month

- Elite - $59/user/month

Disclaimer: The pricing is subject to change.

Congratulations! You’ve made it through the top choices in restaurant accounting software. Now, you have the insights and key details needed to make an informed decision that best fits your business needs and helps your restaurant thrive.

Let’s do a final rundown on this subject at hand—managing a restaurant is about much more than food and service; it’s about making strategic financial decisions that ensure long-term success. The right accounting software can automate time-consuming tasks, reduce costly errors, and give you instant insight into your cash flow, payroll, inventory, and vendor expenses.

With so many powerful solutions on the market, choosing the right tool depends on your restaurant’s size, operations, and financial goals. Whether you need full-service platforms or simple bookkeeping tools, this guide has given you the insights needed to make an informed decision. Pick the software that aligns best with your workflow and budget—and take the first step toward smarter, smoother financial management.

But, if you’re still unsure about which tool to pick, visit our resource center for more software listicles and comparisons.