Managing payroll in the construction industry is a multifaceted job. With fluctuating job sites, tax regulations, and a mix of salaried and hourly workers, traditional payroll systems often fall short. Owing to this problem, construction companies need payroll software that is not only accurate but also flexible enough to handle complex labor tracking, job costing, and compliance needs.

In this blog, we will explore some of the best payroll software for construction companies that can help you manage financial tasks, streamline payroll, reduce errors, and stay compliant.

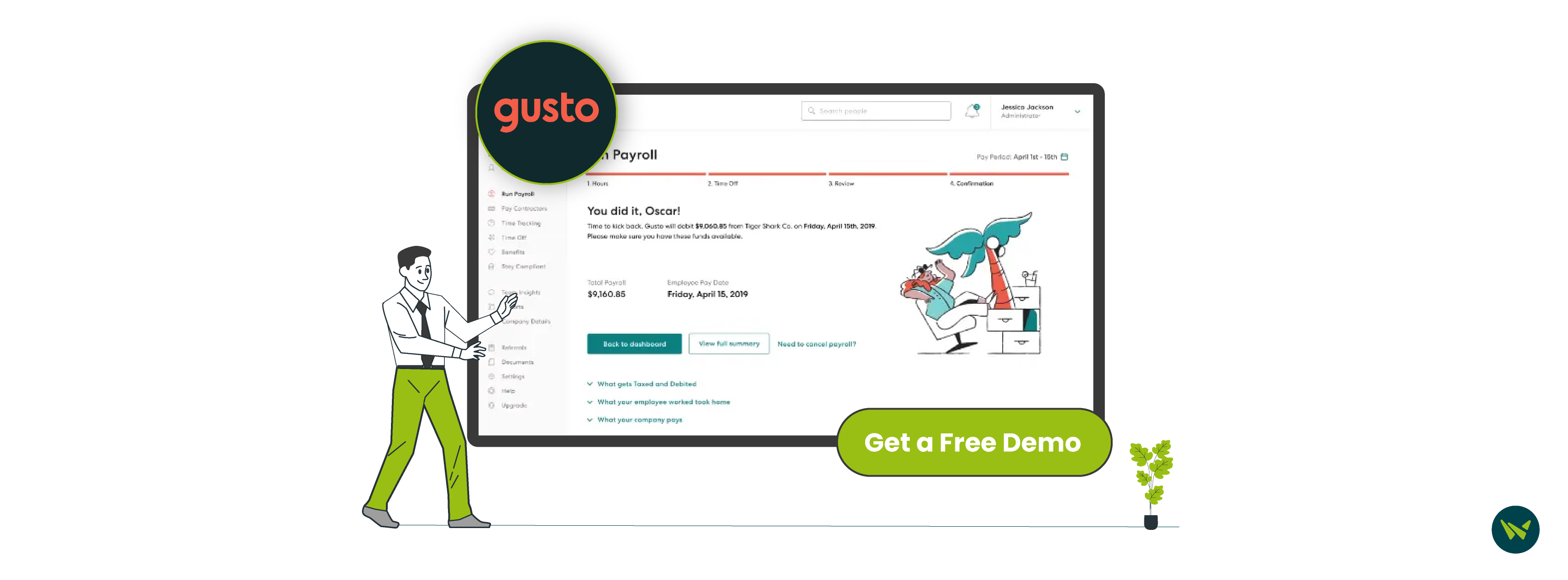

- Gusto HR Software -- Best for global payroll

- Xero Accounting Solution -- Best for bank reconciliation

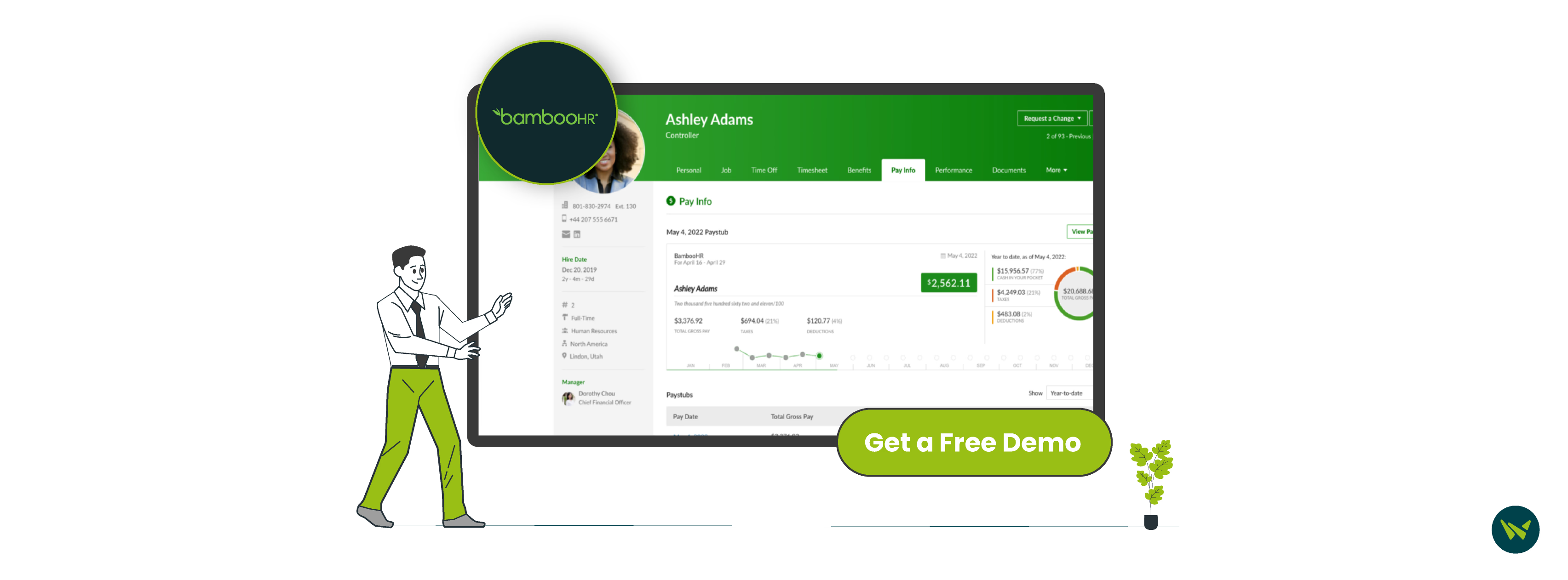

- BambooHR -- Best for multi-rate payroll and tax filings

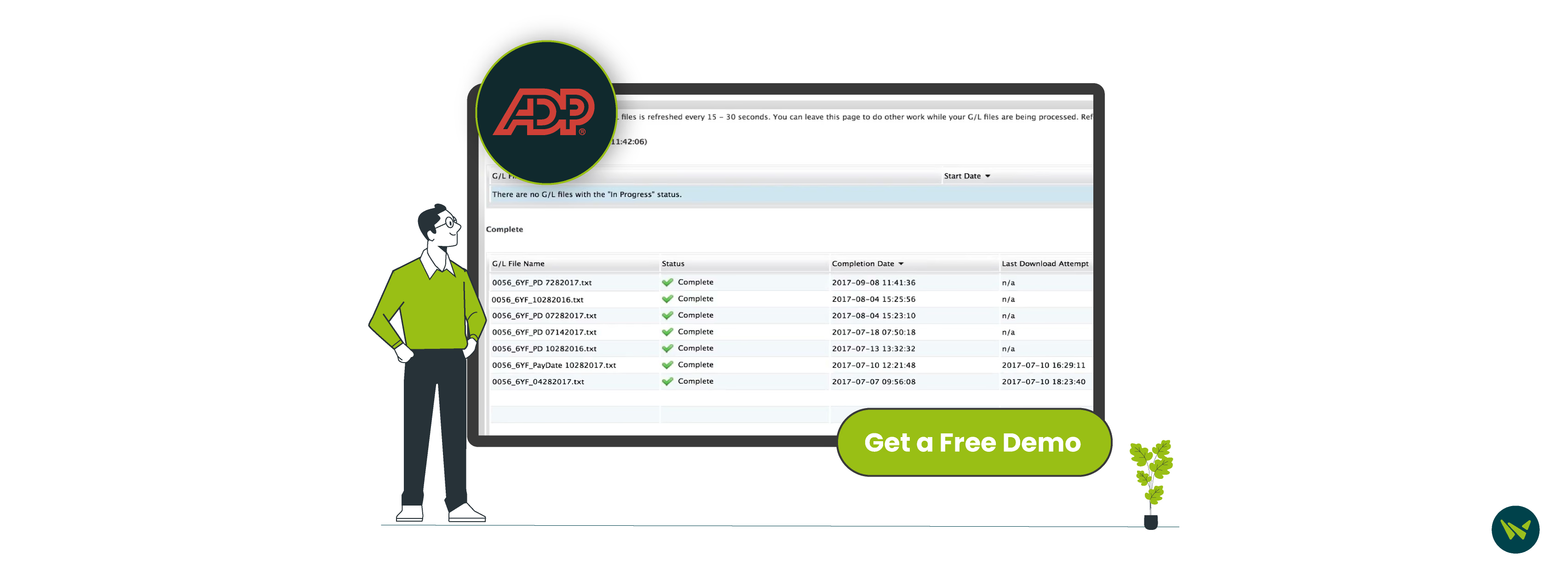

- RUN Powered By ADP -- Best for tracking labor costs

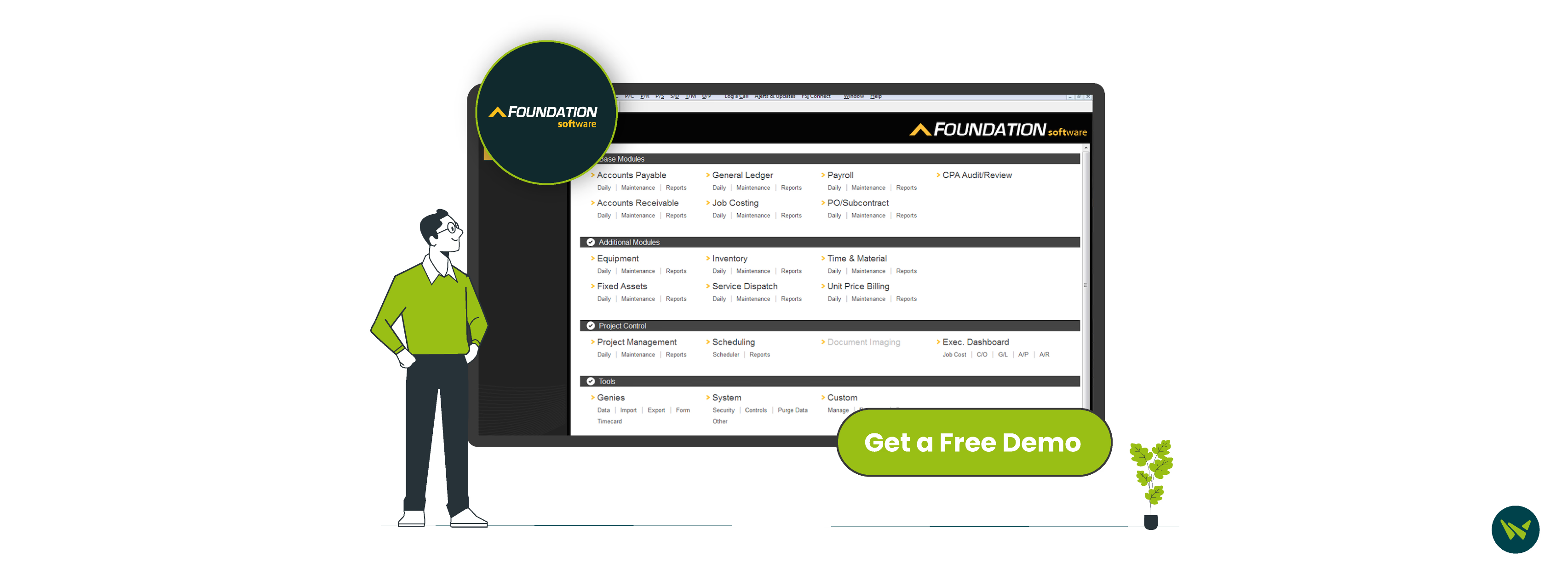

- Foundation Software -- Best for complex payroll tasks

- Justworks -- Best for automating payroll runs

- SurePayroll -- Best for legal compliance

Software | Our Ratings | Top Features | Free Trial |

Gusto | 4.5 ★★★★★ |

| No |

Xero | 4.6 ★★★★★ |

| Yes |

BambooHR | 4.3 ★★★★★ |

| Yes |

RUN Powered By ADP | 5 ★★★★★ |

| Yes

|

Foundation Software | 4.3 ★★★★★ |

| No

|

Justworks | 4.4 ★★★★★ |

| No

|

SurePayroll | 4.5 ★★★★★ |

| No

|

Gusto is a widely praised HR platform, designed to help construction companies streamline various administrative tasks, including payroll. It is ideal for small and midsize businesses as it enables them to automate payroll and ensure accurate pay management with minimal effort and expense.

By leveraging Gusto’s automatic tax filing feature, construction companies can maintain tax compliance and avoid legal trouble. Users can also integrate the platform with other applications, including QuickBooks and Xero, and efficiently manage health insurance, workers’ compensation, etc.

Top Features

- Global payroll

- Schedule creation

- Automatic time tracking

- Workers’ compensation

Pros And Cons

Pros:

- Its efficient reporting makes data analysis easier and accurate

- Precise time tracking leads to effective payroll management

- Payments can be easily scheduled for contractors around the globe

Cons:

- The timesheets cannot be approved from a mobile application

- The absence of reminders on the calendar can lead to missed deadlines

Pricing

The software offers three pricing plans: Simple plan at $49/month plus $6/month/person, Plus plan at $80/month plus $12/month/person, and Premium plan at $180/month plus $22/month/person.

Disclaimer: The pricing is subject to change.

Xero is a cloud-based payroll and accounting platform designed to help construction businesses streamline financial management. Administrators can utilize its features and send invoices and quotes to contractors. They can also monitor expenses and make analytical financial decisions.

Moreover, the platform offers automation tools to reconcile bank transactions, thereby saving companies' time and resources. Construction companies can also leverage Xero's personalized reporting to track cash flow and monitor projects' cost and progress.

Top Features

- Online invoicing

- Bank connections with global institutions

- Multi-currency accounting

- Inventory management

- Accounting dashboard

Pros And Cons

Pros:

- The dashboard offers real-time financial data updates, enabling informed, data-driven decision-making

- The system can seamlessly integrate with other platforms, leading to efficient management of administrative tasks

- The comprehensive inventory module enables effective asset monitoring

Cons:

- The lack of GAAP-compliant workflows may limit performance efficiency

- When invoices are shared, updated credit notes are not shared

Pricing

Xero offers a 30-day free trial, and three pricing packages: Early at $20, Growing at $47, and Established at $80. All plans are billed monthly, and the vendor offers 90% off to new users for the first three months.

Disclaimer: The pricing is subject to change.

BambooHR serves as a full-service platform for construction firms looking to streamline payroll processing and workforce management. By centralizing core HR features, it enables employers to track employees’ working hours, manage benefits, and run error-free payroll.

Additionally, users can also manage multi-rate payroll, project-based pay rates, shift differentials, as well as manage contractors and W-2 employees’ payments. BambooHR also automates tax filings at the local, state, and federal levels, allowing companies to save time and focus on strategic decision-making.

Top Features

- Applicant tracking system

- Custom job posts

- 360-degree feedback

- Personalized reports

Pros And Cons

Pros:

- All functionalities can be easily customized to meet users’ specific needs

- It is a unified platform that offers diverse HR solutions and simplifies tasks

- Essential employee data can be easily accessed through a mobile application

Cons:

- Employees cannot clock in and out using a mobile application, which can be inconvenient when they are running late.

- The geolocation feature may slow down sometimes

Pricing

BambooHR charges a monthly flat rate for companies with fewer than 25 employees, and for businesses with more than 25 employees, it employs a per-employee per-month (PEPM) model. It offers two pricing packages: Core at $6/employee/month and Pro at $9/employee/month.

In addition, the software also offers a free trial for new users.

Disclaimer: The pricing is sourced from third-party websites and is subject to change.

RUN Powered by ADP is a reliable platform for construction companies looking for scalable, accurate payroll solutions. Its user-friendly user interface (UI) allows businesses to run payroll in minutes, whether from the office or the field, helping them stay focused on project management.

RUN ensures regulatory compliance by filing local, state, and federal taxes. Construction firms can monitor individual projects or job labor costs and can accurately track profitability across multiple projects.

Top Features

- Built-in tax compliance

- Automated time tracking

- Mobile application

Pros And Cons

Pros:

- Users can create and update the employee handbook as per the company’s unique criteria

- Efficient employee onboarding functionality expedites the process and saves time

- It provides a diverse library of templates of forms and documents for varying HR needs

Cons:

- The custom report generation can be a bit cumbersome process

- The lack of a detailed wage breakdown may cause confusion among employees

Pricing

For businesses employing 1-49 employees, the software offers flexible pricing plans, starting from $79/month plus $4/employee. It also offers a free trial for the one-employee payroll plan.

Disclaimer: The pricing is sourced from third-party websites and is subject to change.

Foundation Software is a powerful construction accounting and payroll solution that helps contractors and construction firms streamline financial management. By offering an array of back-office tools, it enables employers and managers to address job costing challenges, and more.

Businesses can manage complex payroll tasks, including union payroll, prevailing wage, multi-state payroll, and tax rates on different projects. Users can monitor every dollar, hour, and quantity for each job and gain real-time insights into labor costs, thereby maximizing profitability and avoiding overruns.

Top Features

- Project management

- Purchase orders and subcontracts

- Fixed assets tracking

- Executive dashboard

Pros And Cons

Pros:

- It offers effective learning and training modules for new users

- Reports can be exported in several formats, making data analysis easier

- Its efficient payroll functionality simplifies tracking of payables and receivables

Cons:

- The lack of editing option may complicate the process of updating information

- Limited character space for job description can lead to incomplete postings

Pricing

Foundation offers several pricing plans starting at $500/month. However, depending on the modules selected and company size, its prices vary.

Disclaimer: The pricing is sourced from third-party websites and is subject to change.

Justworks simplifies payroll and workforce management for construction businesses, especially those operating across multiple states. As a Professional Employer Organization (PEO), it combines payroll, benefits administration, HR, and compliance support into one unified platform.

The software automates payroll processing, manages direct deposits, and handles both 1099 and W-2s, an ideal option for a construction business that employs freelance contractors, full-time staff, and subcontractors.

Top Features

- Automated time tracking

- State-level regulatory compliance

- Automated payroll processing

- Workers’ compensation

Pros And Cons

Pros:

- It is a unified platform that enables users to access information on the go

- Efficient benefits administration module that covers dental, medical, and vision insurance

- Seamless financial management, that allows users to track their expenses

Cons:

- The lack of a unified pay stub for multiple deposits may cause confusion

- The absence of printing module for invoices may be inconvenient for users who need physical copies

Pricing

Justworks offers four pricing packages: Payroll at $8/month/employee + $50/month base fee, PEO Basic at $79/month/employee, PEO Plus at $109/month/employee, and EOR at $599/month/employee. Users can also opt for add-on features, that come at an extra cost.

Disclaimer: The pricing is subject to change.

SurePayroll, powered by Paychex, is an online payroll and HR software solution designed for small construction businesses that need simple payroll management. It enables companies to run unlimited payroll, handle direct deposit, and manage tax calculations, all without an extra cost.

Additionally, users can file taxes and stay compliant through the ‘Full-Service Plan’. Its ‘No Penalty Tax Filing Guarantee’ is especially valuable for construction firms working across multiple jurisdictions in avoiding legal and compliance troubles.

Top Features

- Automated payroll

- Custom templates for HR

- 401(k) retirement plans

Pros And Cons

Pros:

- The software’s accurate government filings ensure regulatory compliance

- Running payroll is easy and changes can be made quickly

- Reminders and notifications ensure administrators do not miss out on payroll dates

Cons:

- Making changes in the timecard system can be time consuming

- Limited reports export options can hinder workflows and reduce operational efficiency

Pricing

SurePayroll offers two pricing packages for small businesses: No Tax Filing at $20/month + $4/employee and Full-Service at $29/month + $7/employee.

Disclaimer: The pricing is subject to change.

In summary, all platforms offer comprehensive payroll services for construction companies, helping them meet regulatory requirements. Likewise, choosing which software is the best depends on some factors, the company's immediate needs, workforce size, and location being some of them. Therefore, based on this information, you can select a software solution that aligns with your needs and can help you efficiently pay your workforce.