eBacon is a human resources (HR) software that streamlines construction payroll with integrated tools for certified reporting, wage and benefit management, and compliance tracking. While it lacks real-time updates for account balances, its automation features significantly reduce manual work and payroll errors.

eBacon Specifications

Employee Information Management

Performance Management

Attendance and Time Tracking

Employee Onboarding

What Is eBacon?

eBacon is a cloud-based HR and payroll compliance platform built for construction contractors and subcontractors working on government-funded or prevailing wage projects. The platform consolidates certified payroll, time tracking, fringe benefit management, onboarding, job costing, and compliance reporting into a single system.

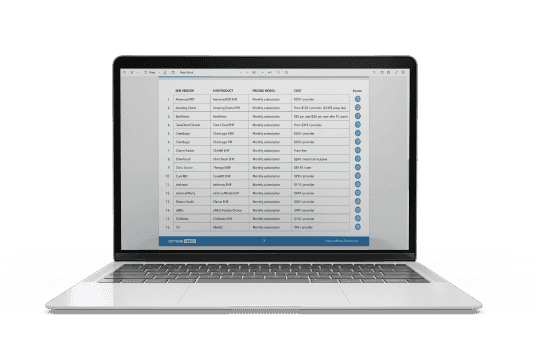

eBacon Pricing

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

eBacon Integrations

The platform offers seamless integration with the following third-party applications:

- QuickBooks

- Oracle

- Sage

- JazzHR

- Checkr

Who Is eBacon For?

eBacon software serves a wide range of industries and sectors, including:

- HR employees

- Accountants

- Construction

- Electronics

Is eBacon Right For You?

Do you run a construction business that handles certified payroll, prevailing wage projects, or complex compliance reporting? eBacon combines time tracking, fringe benefit management, HR tools, and payroll automation into a single platform designed specifically for contractors and subcontractors.

It simplifies WH-347 reporting, automates fringe calculations, and helps ensure Davis-Bacon compliance, all while reducing administrative overhead and saving hours on back-office tasks. eBacon is designed to grow with your business and keep your operations audit-ready.

Still unsure if eBacon is the right fit? Contact our team at (661) 384-7070 to explore your options and get a personalized walkthrough.

eBacon Features

eBacon’s tax management module automatically calculates payroll taxes for both federal and state obligations. The system handles paycheck tax withholding and supports automated tax payment and filing, ensuring timely, accurate return submissions. This reduces manual effort and compliance risk associated with payroll tax reporting.

This feature simplifies compliance by managing fringe benefits through a bona fide fringe trust. Employees can access their fringe funds weekly via direct deposit or pay card and may choose between cash and traditional benefits, such as health insurance, 401(k), FSA, or HSA contributions.

eBacon features a ‘Certified Payroll Reporting’ that is designed to automate, streamline, and ensure compliance for organizations handling prevailing wage and certified payroll requirements. The software reduces manual data entry errors and saves users a significant amount of time, reportedly helping to save up to approximately $67,000 by streamlining reporting workflows.

This feature is designed to give construction businesses comprehensive control and visibility over project expenses, with a strong focus on labor costs. Employees log hours for each project task directly within the platform, providing highly accurate data for job costing, bids, and budgeting.