Wage management, tax compliance, and direct deposits are all essential components of payroll processing. Depending on the size and location of the workforce, manual management of these tasks can be overwhelming.

Cloud-based payroll software addresses these challenges by offering a wide range of tools tailored to key pain points. These platforms enable accountants to automate calculations, run unlimited payrolls, and pay remote employees in their local currencies—no matter where they are in the world.

Owing to these benefits and the growing demand for digital solutions, the market is now filled with various payroll platforms. As a result, finding the one that best suits your specific needs can be a difficult decision.

The following blog explores the best cloud-based payroll software for accountants in detail, helping you identify the solution that best fits your payroll needs.

- Gusto – Best for small and medium-sized businesses

- Paylocity – Best for large businesses and enterprises

- Xero – Best for independent accountants and small businesses

- Workday – Best for small and midsize businesses

- Patriot Software – Best for accountants and small businesses

- Deel – Best for startups, finance, and legal teams

- Wagepoint – Best for accountants and bookkeepers

Company | Standout Features | Main Features | Pricing |

Gusto | Tax registration in all 50 states Payroll across 120+ countries | Gusto Wallet Payroll and tax forms | Starts at $49/month plus $6/month/person |

Paylocity | Payroll in 100+ countries Automates payroll processing | Tax Services On-Demand Payment Garnishment Services | Costs $22–$32 per employee per month |

Xero | Integrates with third-party platforms to facilitate payroll operations | Payroll Management Bank Reconciliation Online Payments | 30-day free trial Pricing starts at $29/month (Starter plan) |

Workday | AI-powered Automates payroll processing | Financial Planning Financial Management Spend Management | 30-day free trial Starts at $42 per employee per month |

Patriot Software | Unlimited payroll runs Efficient tax management | Direct Deposit Service Bookkeeping Service Accounting Reports | Pricing starts at $20/month (Basic plan) 30-day free trial |

Deel | Supports payroll across 130+ countries Global tax compliance | Deel PEO Employer Of Record Contractor Of Record | Starts at $599/employee/month (Deel EOR (Employer of Record) |

Wagepoint | Secure employee self-service portal Time and attendance syncs with payroll | In-App Payroll Calendar Employee Self-Onboarding Automated Calculations | 14-day free trial Cost starts at $20/month + $4/employee (Solo plan) |

Gusto HR Software’s cloud infrastructure provides secure data management services and seamless payroll management. Its automated tax filing and unlimited payroll runs are a testament to its efficiency and user-centric design. Users can easily register taxes in all 50 states of the U.S. while tracking workers’ location and timing to ensure precision and accuracy.

Unique Features

- Global Payroll: Gusto’s global payroll enables companies to pay remote contractors in 120+ countries. Its services are not restricted by borders and time zones, and allowing administrators to manage all payments seamlessly

- Gusto Wallet: The software provides a mobile application, ‘Gusto Wallet’, enabling users to build on savings with each paycheck. Employees can set aside a certain amount from each payroll and access the details via the Gusto app

- Payroll And Tax Forms: Businesses can manage and store all forms online and ensure no federal or local tax compliance. Contractor 1099 and employee W-2 and I-9, Gusto provides all forms in digital format

Pros And Cons

Pros:

- Automatic tax filings and compliance saves time

- Employees can access profiles and view their pay data

- Offers payroll integrated with benefits administration to reduce potential errors

Cons:

- Limited customization can slow down some administrative operations

- Tax withholding overriding does not allow manual entry and can be a little cumbersome

Pricing

Gusto offers three pricing plans: Simple at $49/month + $6/month/person, Plus at $80/month + $12/month/person, and Premium at $180/month + $22/month/person.

Disclaimer: The pricing is subject to change.

Paylocity HR & Payroll automates payroll processing and ensures tax compliance, allowing businesses to focus on more strategic tasks and decisions. Users can save time and resources through its efficient expense management features, while minimizing errors with automated reimbursement. In addition, the platform allows companies to operate globally and pay remote employees across 100+ countries in real-time.

Unique Features

- On-Demand Payment: The platform allows the workforce to access and view their pay details and even request a percentage of it. Employees can view real-time calculations, and the percentage they request is factored within the same pay cycle

- Garnishment Services: Wage garnishment, or the withholding of a certain amount from the employee’s paycheck every month to pay off their debt, is a complicated process. Paylocity offers efficient services to handle such procedures and avoid mishandling of financial data

- Tax Services: Being a ‘Registered Reporting Agent’ with the Internal Revenue Service (IRS) across the U.S., Paylocity offers expert tax advice to its users. Companies can stay tax compliant and avoid legal troubles

Pros And Cons

Pros:

- Powerful recruitment functionality streamlines all hiring tasks

- Payroll processing is seamless and saves time while ensuring accuracy

- Mobile app clock-in and out feature saves time and helps users easily mark attendance

Cons:

- Limited customization options may lead to inefficient workload management

- The lack of screen-sharing functionality can hinder the smooth execution of administrative tasks

Pricing

Paylocity charges a base fee of $39/month + $5/employee. However, depending on selected features and company size, the price ranges between $22–$32/employee/month.

Disclaimer: The pricing information is sourced from third-party websites and is subject to change.

Xero Accounting Solution allows organizations to manage finances, monitor data, and make analytical decisions. Its cloud-computing technology ensures sensitive data security and allows users to access it anywhere, anytime. As the software offers payroll services for small businesses, independent bookkeepers, and accountants only, businesses looking for comprehensive payroll functionality can integrate Xero with third-party payroll platforms and improve their administrative functions.

Unique Features

- Payroll Management: Xero allows users to automate payroll runs, organize the data online, and keep accurate records. Administrators can log employees’ working hours, pay rate, tax details, etc., and instantly calculate accurate payroll

- Online Payments: With Xero, companies can accept online payments from anywhere and speed up their invoicing process. Customers can pay using debit or credit cards and direct deposit as well. In addition, the software charges no subscription fee, only a transaction fee, allowing users to utilize the system efficiently and streamline payment operations

- Bank Reconciliation: The software helps businesses monitor and manage their finances with its advanced ‘Bank Reconciliation’ service. Using this functionality, finance managers can match their accounts balance and details with their receipts, bills, and invoices

Pros And Cons

Pros:

- Provides easy access to financial data, including reports and key metrics

- Efficient integration capabilities, allowing users to streamline various business operations

- The inventory module ensures effective monitoring and management of assets

Cons:

- The forms are not optimally organized, which can make them a bit time-consuming to find

- Limited access to data can hinder workflow efficiency and slow down operations

Pricing

The software offers a 30-day free trial and three pricing plans: Starter at $29, Standard at $46, and Premium at $69. All plans are billed monthly, and the vendor offers 90% for the first 3 months.

Disclaimer: The pricing is subject to change.

Workday Adaptive Planning offers a suite of efficient features, allowing users to streamline various tasks, payroll being one of them. It uses the power of artificial intelligence (AI), enabling businesses to automate payroll processing, sync HR transactions with pay data, and ensure real-time data visibility.

Unique Features

- Financial Management: Users can manage finances and make better financial decisions with Workday. They can gain full visibility across the entire organization and analytically evaluate data trends. In addition, businesses can document every transaction and be mindful of every spend, ensuring smart financial management

- Financial Planning: The software’s AI-powered tool, ‘Workday Illuminate™’, empowers administrators to make predictions based on previous data trends and make up-to-date recommendations. Collectively, these approaches help businesses set and achieve goals easily

- Spend Management: Spend management is a smart way to assess expenses, identify cost-saving opportunities, and drive better budgeting decisions. Workday provides users with tools to achieve all these objectives, and optimize contracts while saving time and spending it on more important and strategic business decisions

Pros And Cons

Pros:

- Users can tailor their workflows as per their company’s unique needs

- Real-time updates keep users updated about their attendance and leave status

- A unified platform to access all the essential business data and workforce information

Cons:

- Email reminders about pending tasks can be overwhelming for some users

- The lack of efficient integration capabilities can limit some of the administrative tasks

Pricing

Workday starts at $42/employee/month and offers the following pricing packages: Workday Adaptive Planning Free Trial comes with a 30-day free trial. Workday Adaptive Planning and Workday Adaptive Planning Close & Consolidation come at a custom cost. Contact Workday to get a quote!

Disclaimer: The pricing information is sourced from third-party websites and is subject to change.

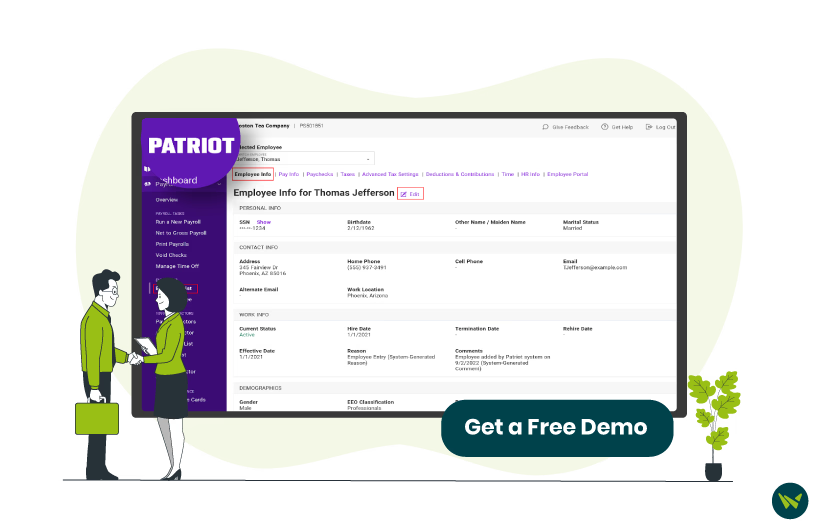

Patriot Payroll offers extensive payroll and accounting services. It offers a set of advanced tools to manage payroll and local, state, and federal taxes. Companies can utilize their services and manage contractors’ payments, run unlimited payrolls, and manage payroll forms, including 1099 and 401k.

Unique Features

- Bookkeeping Service: Accounting specialists at Patriot Accounting help businesses manage bookkeeping tasks and other financial data. Users can opt for this service for a minimal fee and let the experts handle their bank transactions and financial reports

- Accounting Reports: Businesses can manage expenses and make predictions based on data forecast with the software’s comprehensive accounting reports. Users can review income, revenue, and net profit, and download the reports in PDF form for later reviewing

- Direct Deposit Service: The platform offers free 2-day and 4-day direct deposit payroll to its customers, allowing them to pay their employees and remote or independent contractors with ease. Administrators can also print checks right from the software

Pros And Cons

Pros:

- The automatic filing of federal, state, and local taxes saves time and ensures compliance

- Users can access and print out various payroll reports, including 1099s and 1096s

- Seamless integration with QuickBooks ensures smooth execution of financial operations

Cons:

- Configuring the text fields for preprinted paychecks can be cumbersome

- Scheduling a recurring payroll or several weeks at once can be a bit challenging

Pricing

The platform offers different pricing packages for accounting and payroll services: Accounting Basic at $20/month, Accounting Premium at $30/month, Basic Payroll at $17/month, and Full Service Payroll at $37/month. In addition, Patriot Payroll offers a 50% discount for the first 3 months of subscription and a 30-day free trial.

Disclaimer: The pricing is subject to change.

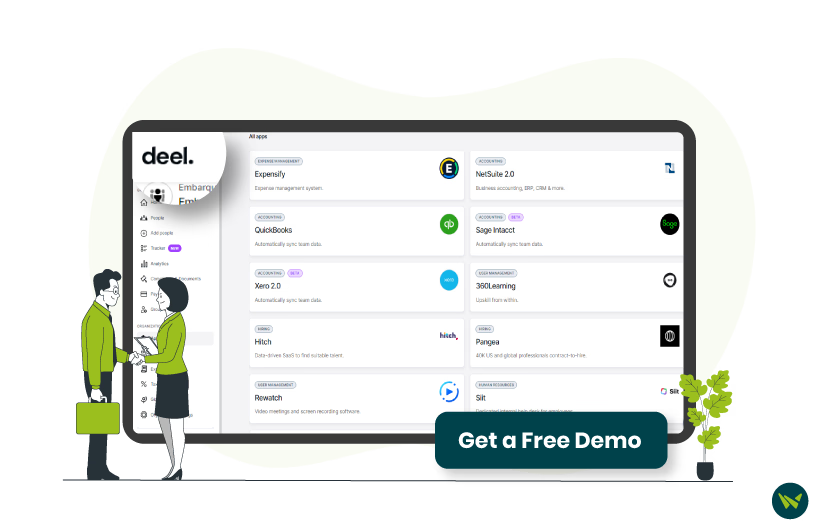

Deel uses its cloud-based architecture and a comprehensive suite of features to help organizations achieve their goals and expand globally. Its U.S.-based users can run accurate payrolls in minutes and streamline tasks. Plus, businesses managing remote teams can pay employees and contractors across 130+ countries, while ensuring compliance and tax regulations.

Unique Features

- Contractor Of Record: The software empowers administrators to avoid misclassification of employees, manage contracts, global payments, and inventory, all through its centralized platform. Companies can also hire and onboard employees globally, automated invoices, and streamline all administrative tasks efficiently

- Deel PEO: Deel offers ‘Professional Employer Organization’ (PEO) services, allowing businesses to easily manage their teams and workforce. From HR management to recruitment and legal compliance, the platform takes responsibility of all these tasks

- Employer Of Record: By allowing ‘Employer Of Record’ (EOR) services across 150+ countries, Deel takes the full legal responsibility of organizations and maintains compliance on their behalf. It also provides advanced data security measures, protecting sensitive user information from cyberattacks

Pros And Cons

Pros:

- Streamlines recruitment and onboarding for companies with global operations

- Helps companies navigate and exercise local labor laws and stay compliant

- Offers efficient payment processing with minimal charges for each transaction

Cons:

- Limited integration capabilities can hinder administrative efficiency

- May require enhanced customization and reporting for more complex use cases

Pricing

Deel offers several pricing plans, catering to HR, payroll, and IT needs of businesses, all billed monthly. The details are:

Deel Payroll offers several plans: Deel EOR (Employer of Record) at $599/employee/month, Deel Contractor Management at $49/contractor/month, and Deel Contractor of Record starts at $325/contractor/month.

Deel HR offers Deel Engage at $20/worker/month.

Deel IT offers two packages: Device Lifecycle Management at $18 per device per month and Mobile Device Management at $9 per device per month.

Deel Services offers two plans at a custom cost: Immigration and Entity Set Up. Get in touch with Deel to get a quote price.

Disclaimer: The pricing is subject to change.

Wagepoint’s popularity stems from its seamless payroll management and intuitive user interface. Businesses can send direct deposits while empowering employees to access and view their payment details through their employee self-service portal.

Plus, the software syncs time and attendance with payroll, so it is easier to calculate accurate billable hours and avoid potential errors.

Unique Features

- Employee Self-Onboarding: Through the software’s powerful self-onboarding functionality, employers can expedite the employee onboarding process and help them adhere to company culture easily

- In-App Payroll Calendar: Administrators can manage finances and make smart decisions with Wagepoint’s in-app calendar that shows bank holidays, payroll dates, etc. Companies can also make date adjustments and seamlessly management payment processing

- Automated Calculations: Wagepoint automates calculations for finance managers, enabling them to focus on other essential tasks, including benefits management, custom payroll, and deductions

Pros And Cons

Pros:

- User information can be easily access via the mobile application

- Efficient integration with leave management makes payroll accurate

- Autopay and source deductions streamline the process and save time

Cons:

- The absence of ad-hoc and personalized reports can be challenging and time-consuming

- The lack of auto-save functionality makes manual saving necessary, which can slow down workflows

Pricing

Wagepoint offers a 14-day free trial and two payroll plans: Solo at $20/month + $4/employee, and Unlimited at $40/month + $5/employee. People by Wagepoint starts at $3/user/month, with Studio at $5 and Growth at $6. It also offers an Enterprise plan with custom cost for larger teams.

To wrap it up, our above discussion highlights how all platforms offer efficient payroll services while upholding data security and safety standards. Whether you need to manage global payroll, direct deposit, remittances, or tax filing, these software solutions provide all these functionalities, and more. That said, based on your pressing needs and budget, you can easily pick the one that seems the best fit for your organization and streamline your tasks.