For Human Resources (HR) and finance teams, managing payroll manually is slow and error-prone. Companies want automation to reduce repetitive administrative tasks like calculations, filings, and pay distribution.

Payroll software makes this task easy to manage for companies by automating the entire process. It uplifts the burden of manual workload from the teams and helps them focus on other meaningful work, such as planning strategic growth activities for employees and overseeing training projects.

In this article, we shall explore what payroll software is, its key features, considerations, and benefits of using such solutions. Let’s dive deeper into the details.

Payroll software is a cloud-based or on-premises solution that automates essential HR tasks, including calculation of wages, deduction of taxes and benefits, and processing payments like direct deposits. Its key functions include time tracking, managing compliance with labor laws, handling tax filings, and provision of reporting and data security. Since employment laws and regulations constantly keep evolving, companies find it challenging to keep up. However, with a payroll system in place, organizations of all sizes can stay compliant with all taxation and financial regulations in real time.

Some payroll solutions also offer employee self-service portals to company workers for accessing pay stubs and personal information. It frees HR and finance teams from the routine administrative tasks and allows them to spend more time on budgeting, planning, and other business-forward initiatives.

It is common to assume that all payroll software features are the same. However, different payroll systems offer different features. When comparing different solutions, take into consideration the following key features of a full-service payroll system:

Direct Deposit

This is usually considered one of the most important payroll software features for the employees of a company. It lets employees get instant access to their paychecks. HR and finance teams do not need to print and distribute paychecks as the entire process becomes automated.

Expense Management

For companies incurring reimbursable employee expenses, such as travel and lodging, most payroll software offer expense management capabilities. These systems automate expense reports and payment procedures, ensuring the timely reimbursement of expenses. Apart from that, they also ensure that the records are accurate.

Tax Filing

Another important feature of payroll software is automated tax filing. Payroll software calculate, withhold, and submit the correct tax amounts to authorities. Also, to minimize errors and penalties, these solutions also stay updated with current tax laws.

Payroll Integration Capabilities

Many payroll systems offer integrations that allow connecting with other company applications or software, such as accounting, HR, and time tracking systems. Due to such connectivity, data sharing stays consistent across multiple platforms.

Flexible Payment Methods

Automated payroll software offer flexible payment methods, such as paychecks, direct deposits, and pay cards. The system calculates net pay after deductions and initiates payments accordingly.

Holistically speaking, payroll software generally eliminates many headaches associated with taxes, compliance, and industry regulations. Other than that, to make you understand the importance of payroll software, here are the common benefits of using a dedicated payroll system for your company:

It is important to note that not all payroll systems are made equally. Some serve small teams, while others are designed for larger organizations. Some offer global payroll, while others cater to the local payroll requirements.

The top five most common types of payroll software are mentioned below:

Manual Payroll System

As the name suggests, this payroll system involves the calculation of deductions, wages, and taxes by hand. Typically, small businesses with a limited number of employees opt for this system.

Payroll Software System

A payroll system automates payroll tasks, including the calculation of salaries, tax deductions, and the generation of pay stubs. Companies seeking to minimize errors and save time prefer these systems.

Online Payroll Services

These are cloud-based platforms that can automatically handle payroll processing, managing direct deposits, and more. Companies do need a stable internet connection and a continuous subscription cost to maintain these systems.

Payroll Card System

Such systems let employees receive their wages on prepaid debit cards instead of paper checks or direct deposits. This system works best for workers not having traditional bank accounts.

Outsourced Payroll Systems

Again, as the name suggests, outsourced payroll software involves hiring a third-party company for the purpose of handling all payroll-related tasks. Companies that do not host an in-house payroll department outsource their work to external companies.

Payroll can be complex for organizations due to the ways employees are paid, depending on their industry and role. A payroll system usually handles the following four kinds of pay structures:

Depending on these four types of pay structures, companies need different software to run payroll. Either they outsource payroll to an external company or they set up an in-house department to handle everything effectively.

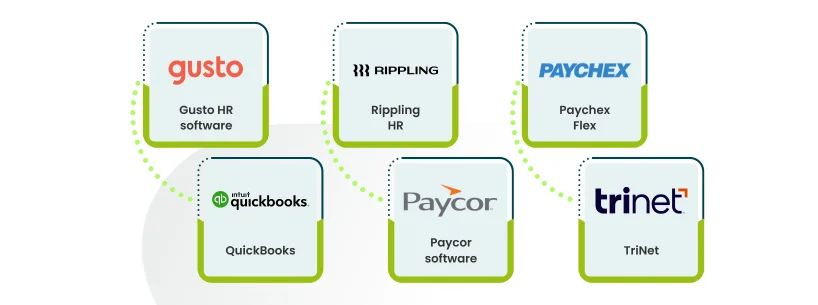

Examples Of Payroll Solutions

Once you have a clear idea of what you need, it's time to find out the best payroll system for your business. You can consider the following excellent options to run payroll best practices:

If you are planning to determine the best payroll system for your business, review these crucial considerations before making a choice:

Payroll software is a necessity for modern businesses as it manages compensation, compliance, and reporting while reducing errors and administrative burden. By understanding how payroll software works, exploring its features and benefits, and weighing key challenges, organizations can make informed decisions that align with their needs.

With various types and examples available, payroll systems offer flexibility and scalability to support growth. Based on this information, you can choose the right payroll software that will ensure compliance and enhance the efficiency of your payroll workflows.