Every business relies on payroll software because it ensures accurate and timely compensation. But things change the moment your company starts to grow. Managing payroll across multiple teams, locations, or even subsidiaries becomes more complex—especially when tax laws vary, pay schedules overlap, or different currencies are involved.

Fortunately, several cloud-based payroll platforms in 2025 offer the flexibility to support businesses of all sizes and types. It doesn’t matter if you’re a startup, a mid-sized company, or an enterprise with multiple operations under one roof. The payroll solutions we’re going to talk about in this blog are built to support businesses across virtually every industry.

We’ll highlight 10 of the top payroll software solutions for managing multiple companies. For each platform, you’ll find its standout features, best use cases, real-world customer examples, pricing details, and a quick summary of pros and cons. Let’s get started!

Company | Rating | Trial Info | Pricing | Best For | Main Features |

4.4/5 | 30-day free trial | Starts at $79/month + $4/employee | Mid-to-large companies with complex payroll needs |

| |

4.5/5 | 90-day free trial | Starts at $39/month + $5/employee | Small to midsize businesses wanting an all-in-one HR + payroll solution |

| |

4.5/5 | 7-day free trial | Starts at $49/month + $6/employee | SMBs using QuickBooks or managing remote teams |

| |

4.9/5 | No free trial | Starts at $8/employee/month | Tech-driven teams needing all-in-one HR, IT, and payroll |

| |

| Paylocity | 4.3/5

| No free trial

| Custom pricing | Small to mid-sized businesses seeking payroll + HR (HCM) | Global payroll management, time and attendance management, and employee experience tools |

4.1/5 | No free trial | Estimated $27–$37/employee/month | Large enterprises in industries like healthcare, retail, and hospitality |

| |

N/A | 60-day free trial | $24–$31/employee/month | Global companies needing real-time payroll and compliance |

| |

4.5/5 | No free trial | $25–$36/employee/month | Medium to large businesses valuing dedicated support |

| |

3.9/5 | 30-day free trial | Starts at $50/month (Core plan) | Small to mid-sized businesses already using QuickBooks |

| |

4.3/5 | 7-day free trial | $75/month for 10 employees + $4.25/additional employee | Companies already using BambooHR for HR functions |

|

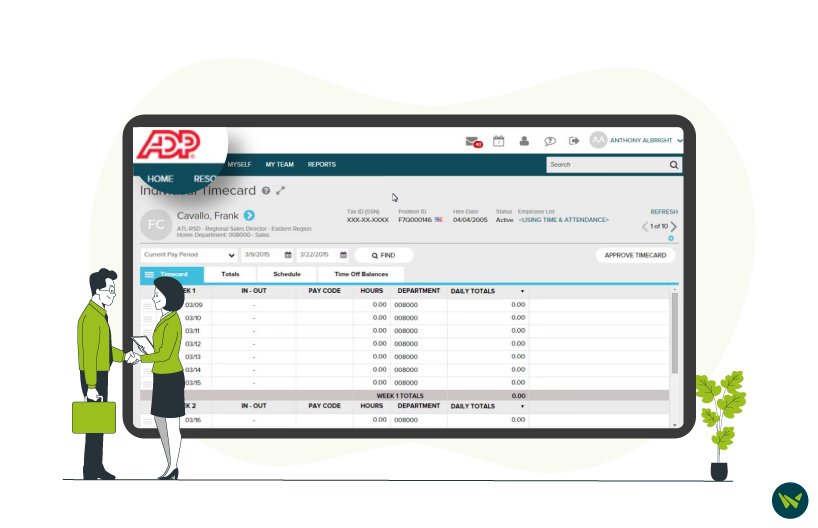

ADP Workforce Now is a well-established name in the payroll space, trusted by organizations of all sizes. What sets ADP apart is its ability to manage global payroll at scale—supporting compliance in over 140 countries, which is a major advantage for international organizations. Another benefit is that it supports multiple payment options, including direct deposit, paycards (Wisely® by ADP), and traditional checks, catering to diverse employee preferences. Plus, its built-in dashboards give you a clear view of pay trends, liabilities, and what’s driving payroll costs—without needing extra tools.

It is one of the largest payroll providers in the world. According to ADP, over 1,100,000 clients use its solutions in 140+ countries. Big names like Amazon, Dell Technologies, and Steve Madden are part of that number.

Best For: Its scalability makes it suitable for mid-to-large companies with complex payroll needs, including multi-state teams or unionized workforces.

Pros

- Tracks employee benefits and available options for better decision-making

- Supports easy data imports and bulk payroll updates

- Manager dashboard provides visibility into timecards, shifts, and time-off

Cons

- Reporting tools can be difficult for non-technical users to navigate

- Rehiring a former employee creates duplicate records/W-2s

Pricing

ADP Workforce Now pricing reportedly starts at $79/month, plus $4/employee. This plan includes core payroll processing, tax filing, direct deposit, and basic compliance support.

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

Paychex Flex combines payroll and HR in one platform. Its core offering includes full-service payroll with automatic tax filing at the federal, state, and local levels. One of its standout features is the Paychex Pre-check℠ tool, which lets employees preview their pay info before payroll is finalized—helping catch errors early.

The part that’s most helpful in practice is that it offers 24/7 support in all plans. That kind of availability is useful when payroll needs attention outside regular hours or when tax-related issues come up.

It serves over 800,000 clients, including companies like Gusto and The Hunger + Thirst Group, reflecting its presence across various industries.

Best For: This system works well for small to midsize businesses (including multi-location franchises) that want an all-in-one HR + payroll solution with strong support.

Pros

- Its mobile app is convenient for checking paystubs, hours, and clocking in/out

- Sends helpful and timely alerts for paystubs

- User-friendly interface for both desktop and mobile

Cons

- Errors with clock-in/out, GPS coordinates, and syncing problems noted

- A few users noted tax errors and late filings that caused complications

Pricing

Paychex Flex offers payroll packages starting at $39/month, plus $5/employee/month.

Disclaimer: The pricing is subject to change.

Gusto HR software is a well-known name in the payroll space, especially among small to mid-sized businesses. A standout feature is Gusto Global, its built-in employer of record (EOR) service powered by Remote. With this, you can hire and pay employees or contractors in over 120 countries—without setting up a local entity. Payments are made in local currencies, and compliance is managed in the background. For companies expanding internationally, this removes a major hurdle.

Another feature worth highlighting is the Gusto Wallet—a financial wellness tool that lets employees save directly from their paychecks. It also offers free withdrawals at over 37,000 ATMs across the U.S., adding extra convenience for employees.

Over 400,000 companies, including names like Goldbelly and Kids Atelier, already rely on Gusto.

Best For: It is ideal for companies already using QuickBooks or other accounting tools and those with distributed teams (remote workers) since it handles 50-state compliance.

Pros

- Lets users easily access important details like taxes, pay stubs, and benefits

- Sends automatic reminders for payroll and due dates for timely task completion

- Acts as a central hub for tasks like PTO requests and expense reporting

Cons

- Geofencing isn’t always accurate and can log users outside the set zone

- No option to set recurring payments for contractors—must be entered manually each time

Pricing

Gusto’s payroll starts at $49/month + $6/person/month with the Simple Plan, and it also offers a ‘Global Contractor Payments’ add-on for paying international contractors.

Disclaimer: The pricing is subject to change.

Rippling HR stands out for businesses managing complex payroll across multiple entities or countries. What makes it different is how seamlessly it connects payroll with other systems—like time off, benefits, expenses, and even IT equipment tracking

From a user perspective, not needing separate platforms for different regions is one of Rippling’s strongest points. It supports both domestic and international payroll from a single system, so that you can pay employees in the U.S. or 85+ countries, with payments available in over 50 currencies.

Not only that, but it’s trusted by 20,000+ companies, including well-known names like Jasper, Barry’s, and Forterra.

Best For: This one is a solid choice for tech-driven teams that want all-in-one control over HR, IT, and payroll, with the flexibility to integrate with 500+ apps.

Pros

- Simplifies health insurance selection with easy plan comparisons and smooth setup

- Intuitive interface ensures a seamless experience for admins and employees

- Regular feature updates and cost-saving options like PEO integration for payroll and HR

Cons

- Basic automation is limited to lower-tier plans; advanced tools require an upgrade

- Task reminders only allow daily alerts or full deactivation—no custom scheduling

Pricing

Rippling’s base payroll pricing starts at $8/employee/month, which covers core payroll features.

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

Paylocity HR & Payroll is designed for businesses that seek to unify HR and payroll tools in one platform. The main area of strength for Paylocity is how well it links everyday HR tasks with payroll, time tracking, and employee engagement. It is also a Registered Reporting Agent with the Internal Revenue Service (IRS) in all 50 states, the Virgin Islands, Guam, and Puerto Rico, which enables it to automate tax filing, reconcile funds, and help companies stay compliant.

For companies operating across multiple locations in multiple states, tracking worked hours and ensuring that it accurately translates into payroll is a hassle. Paylocity addresses this by syncing time and attendance data directly with payroll and improving paycheck accuracy with 40+ audit checks flagging any potential errors.

Moreover, organizations using Paylocity can also leverage AI-powered insights. Its proprietary Modern Workforce Index (MWI) gives leaders data-driven recommendations on engagement, turnover risk, and workforce health.

Best For: Small to mid-sized businesses that want a streamlined payroll + HR system with automation, built-in communication, and strong employee experience tools.

Pros

- Offers an easy-to-use interface and accessible support

- The peer recognition feature is appreciated by users for enhancing engagement

- The mobile app is convenient for clocking in/out, reviewing schedules

Cons

- Some users mention occasional syncing delays between time tracking and payroll

- Custom reports can require additional setup

Pricing

Paylocity offers custom pricing plans that vary depending on the company’s size and modules selected. The available modules include:

HR

- Workforce Management

- Talent Management

- Benefits Management

- Employee Experience Platform

- Marketplace Integrations

- Beyond Traditional HRIS

Finance

- Expense Managment

- Corporate Cards

- Accounts Payable Automation

- Guided Procurement

- Headcount Planning

IT

- Access Management

- Asset Management

- Integrations And Developer APIs

UKG Pro is built for enterprises that need global payroll and HR tools under one roof. It supports payroll in 160 countries and simplifies cross-border payments in over 120 currencies. That level of reach is useful for companies managing large, distributed teams.

One useful aspect is its support for 20+ languages and its ability to run U.S. and Canadian payroll from the same system. Another thing that genuinely saves time is how it manages complex calculations like shift differentials, overtime tiers, and pay averaging.

UKG is used by over 80,000 organizations worldwide. That includes big names like SpaceX, Toyota, Mars, and Crescent Hotels & Resorts (which runs payroll and time for 10,000 employees across 120+ properties with UKG).

Best For: It's widely used by large enterprises (often 1,000+ employees) in industries like healthcare, hospitality, retail, and manufacturing—sectors that require tight payroll syncing and compliance.

Pros

- Offers tightly integrated features that streamline complex HR and payroll processes

- It can easily be accessed on any device—laptop, desktop, tablet, or phone

- Includes pre-built workflows to assign tasks at shift start, helping teams stay on track and meet deadlines

Cons

- The platform’s depth and range of features can feel overwhelming for users new to HR software

- Employees need admin approval to access the mobile app, which can delay setup and usage

Pricing

Estimates suggest that UKG Pro's payroll services typically range from $27 to $37/employee/month.

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

One of the more practical things about Dayforce is how it updates payroll in real time. Time entries sync instantly, which helps reduce errors and gives more flexibility to run payroll without waiting for batch calculations. It’s a model that works well for companies dealing with frequent schedule changes or hourly staff.

Global payroll is also built in, with support for over 200 countries. Local compliance tools are part of the system, which makes things easier if you're managing teams in multiple regions.

There’s also an on-demand pay feature called ‘Dayforce Wallet’, which gives employees early access to earned wages. It comes with a prepaid Mastercard that they can use for purchases, bills, or ATM withdrawals.

According to Dayforce, over 7 million users rely on its platform. Companies like Danone, Gannett, and Costa Coffee are among them.

Best For: This will be a perfect fit for very large and global companies that need payroll in multiple countries with strong integration to scheduling and time tracking.

Pros

- This system frequently adds, or updates features to match evolving business needs

- Payroll data can be exported to external accounting or HR tools

- Built-in audit alerts help catch payroll errors before submission

Cons

- No way to attach files or track email replies

- Customizing forms and reports can be difficult without IT support

Pricing

As of 2024, Ceridian Dayforce's payroll pricing typically ranges from $24 to $31/employee/month, depending on the modules selected and company size.

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

Paycom takes a different approach by having employees enter their hours and expenses. Its Beti® engine then uses that data to build payroll automatically. It’s a system that can cut down on admin time, but it assumes employees will get everything right.

What also helps is that everything lives on one platform. There’s no switching between apps, and data stays synced across HR and payroll. Not only that, but it also includes GONE®, a feature that auto-approves PTO requests using AI. Each client gets a dedicated payroll specialist, so you don’t end up waiting in a support queue when something goes wrong.

Paycom Pay® is another addition worth noting. It supports both direct deposit and physical checks, but the key benefit is that it removes the need for manual check reconciliation—something that can quietly take up more time than most teams realize.

It serves 37,500+ clients as of end-2024. Its users include well-known names like Dominion Care and Prairie Knights Casino.

Best For: This works well for medium to large businesses (often 100–10,000+ employees) looking for heavy automation. Paycom’s unique selling point is its service model, so clients who value white-glove support and having one dedicated person handling their account will benefit.

Pros

- Combines timekeeping, expenses, and time off to cut manual work

- Sends alerts for process changes and policy updates

- Employees can update hours, benefits, and time off via the app

Cons

- Interface can feel clunky and hard to navigate

- Copying reports may distort formatting in external documents

Pricing

Paycom's payroll pricing typically ranges from $25 to $36/employee/month, depending on factors such as company size and the specific modules selected.

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

QuickBooks Payroll is designed for small businesses, especially those already using QuickBooks for accounting. The integration is smooth, and having both payroll and bookkeeping in one place does help cut down on manual work.

At the entry level, you get full-service payroll with automatic tax calculations, filings, unlimited payroll runs, and the next-day direct deposit. From a usability standpoint, it's straightforward and works well for small teams that need to get payroll done without complications.

What you get in the higher-tier plans is more support-focused—same-day direct deposit, automated payroll schedules, and access to a personal HR advisor. There's also tax penalty protection on the Elite plan, which covers up to $25,000. That won’t apply to every business, but it could be useful for those worried about tax compliance.

One more thing to flag is that the built-in time tracking is included on the Premium and Elite tiers. It’s enough for basic clock-in/clock-out needs, though it may not go far enough for teams with complex scheduling or job costing requirements.

It’s also worth noting that Intuit claims 7 million customers globally using its platform.

Best For: This one makes more sense for very small to mid-sized businesses (up to a few hundred employees) already using QuickBooks or seeking simple payroll.

Pros

- Includes a free onboarding call to help with quick setup

- Automatically syncs with bank accounts to streamline transactions

- Lets you create and save bookmarks for tasks you perform often

Cons

- The online version offers limited customization options

- Customer support responses can be delayed at times

Pricing

The starting price for QuickBooks Online Payroll (without discount) is $50/month for the QuickBooks Payroll Core plan.

Disclaimer: The pricing is subject to change.

BambooHR is mainly known as an HR platform, but it also offers a built-in U.S. payroll add-on. The payroll side is focused on simplicity and compliance, with automatic filing of federal, state, and local taxes.

Employees can access their pay stubs, update tax withholdings, and change direct deposit info right from their BambooHR profile or mobile app. From an employee perspective, the self-service tools are easy to use.

One feature that stood out is support for multi-rate payroll. You can assign different pay rates based on roles or projects, which is especially useful for contractors or seasonal staff. Hours tracked in BambooHR feed directly into payroll.

There’s also a Custom Journal Entry Builder that helps map payroll data to your accounting system. Other features include W-2 generation, unlimited pay runs, garnishment support, and an audit trail for added visibility.

The company has reported it’s used by over 34,000 customers—including companies like Civtec and Avidbots.

Best For: This system is ideal if you already use or plan to use BambooHR for HR (benefits, onboarding, performance) and want payroll in the same system.

Pros

- Let employees manage their details and HR documents, reducing manual workload for HR

- Clean, intuitive layout makes it simple for non-technical users to get started

- Custom reports can be generated easily for better data access and analysis

Cons

- Adjusting timesheets can be tricky if someone forgets to clock out

- Due to wide customization, setting up certain HR workflows may require more time initially

Pricing

BambooHR Payroll starts at $75/month for 10 employees, with an additional $4.25/month for each extra employee.

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

Managing payroll across multiple companies or entities adds complexity, and not every tool is built to handle it well. Some platforms on this list—like ADP, Rippling, and UKG Pro—are clearly built for scale and international compliance. Others, like Gusto and QuickBooks Payroll, are easier to get started with if your team is still growing.

What stood out across the board is how most of these tools now offer some form of automation, employee self-service, or integration with accounting and HR systems. That said, not every platform gets everything right. In some cases, you’ll get strong automation but limited customization. In others, support might be slower, or certain features may only be available at higher tiers.

However, if you’re just getting started, try focusing on what matters most: error-free processing, flexibility across teams or locations, and visibility into your payroll costs. Once those boxes are checked, everything else becomes easier to manage. You can also check out our software guides for deeper comparisons before making a final call.