Managing payroll for a small (S) corporation comes with unique challenges that require careful attention to Internal Revenue Service (IRS) regulations, especially when it comes to compensating shareholder-employees correctly. Choosing the right payroll software can simplify this complex process by automating tax calculations, ensuring compliance, and streamlining employee payments.

Whether you’re a small S-corp just starting out or a growing business looking to scale, finding a well-suited payroll solution is essential for maintaining smooth operations and avoiding costly penalties. In this blog, we will explore the best payroll software for S-corp, helping you make an informed decision that saves time, reduces errors, and supports your business growth.

Software | Our Ratings | Top Features | Free Trial |

SurePayroll | 4.5 ★★★★★ |

| No |

OnPay Payroll | 4.7 ★★★★★ |

| Yes |

ADP Workforce Now | 4.5 ★★★★★ |

| No |

Patriot Payroll | 5 ★★★★★ |

| Yes |

Gusto HR Software | 4.5 ★★★★★ |

| No |

QuickBooks | 4.5 ★★★★★ |

| Yes |

Wave Payroll | 4.5 ★★★★★ |

| Yes |

SurePayroll by Paychex is an online payroll software solution that optimizes payroll processing, HR tasks, tax management, etc., for small businesses, including S-corp. It automates payroll cycles, calculates and files taxes, and provides direct deposit services, all accessible from any smart device. By partnering up with Paychex Insurance Agency, the software helps employers find and employ the best healthcare plans for their workforce.

Top Features

- Tax filing (local, state, and federal)

- Free direct deposit

- Custom templates for compliance

- Automated payroll system

Pros And Cons

Pricing

The software offers two pricing plans for small businesses: No Tax Filing ($20/month + $4/employee) and Full-Service ($29/month + $7/employee).

Disclaimer: The pricing is subject to change.

OnPay Payroll is a full-service payroll software that optimizes payroll, HR, benefits management, etc. It helps users pay employees and contractors in just a few clicks and automatically handles all calculations, deductions, and payroll taxes to ensure accuracy and compliance. The software seamlessly integrates with accounting platforms and benefits providers, making it easy to keep everything in sync and reduce potential errors.

Top Features

- Payroll automation

- Custom payroll reports

- Personalized onboarding workflows

- Workers’ compensation

Pros And Cons

Pricing

The platform costs a base fee of $49/month plus $6/employee/month. It also offers a 30-day free trial.

Disclaimer: The pricing is subject to change.

ADP Workforce Now utilizes its cloud-based technology to provide comprehensive payroll and HR solutions, trusted by businesses of all sizes. Designed to help organizations manage payroll efficiently, it offers automated payroll processing, tax filing, and compliance support—all in a centralized platform. S-corp owners can particularly benefit from its features that streamline employee payments, ensure accurate tax withholdings, and support regulatory compliance, which is crucial for managing shareholder-employee compensation.

Top Features

- Automated time and attendance monitoring

- Shift scheduling

- Automated payroll processing

- Live HR support

Pros And Cons

Pricing

ADP Workforce Now offers custom pricing packages: Select, Plus, and Premium. All plans provide payroll, onboarding, and HR services. In addition, users can also get additional features for an extra fee.

Patriot Payroll is a powerful accounting software that streamlines payroll, bookkeeping, and similar functions. Businesses can create, send, and monitor invoices while generating detailed financial reports to accurately manage and evaluate payment data. Plus, the software allows users to run unlimited payroll by utilizing its full-service payroll service. Moreover, Patriot helps organizations efficiently track the workforce’s time and attendance, sync its data with payroll, and run precise and error-free pay cycles.

Top Features

- Unlimited payroll processing

- Free direct deposit

- Employee self-service portal

- Custom HR documents’ templates

Pros And Cons

Pricing

The software offers two pricing plans: Accounting Software, which further offers two sub-plans (Accounting Basic at $20/month and Accounting Premium at $30/month), and Payroll Software with two sub-packages (Basic Payroll at $17/month + $4/worker and Full Service Payroll at $37/month + $5/worker).

Patriot Payroll also offers a 30-day free trial.

Disclaimer: The pricing is subject to change.

Designed particularly for startups and small businesses, Gusto has built a reputation for its powerful payroll and HR services. It automatically files users’ taxes in all 50 U.S. states, ensuring their compliance and reducing workload. The platform also helps administrators get valuable insights from licensed advisors and create health insurance plans for their employees. Along with time monitoring, talent and performance management, and more, Gusto ensures S-corps can focus on their workforce and efficiently manage day-to-day administrative tasks.

Top Features

- Auto-tax calculations

- International payroll (120+ countries)

- Custom reports

- Employee pulse surveys

Pros And Cons

Pricing

The platform offers three pricing plans: Simple ($49/month + $6/month/person), Plus ($80/month + $12/month/person), and Premium ($180/month + $22/month/person).

Disclaimer: The pricing is subject to change.

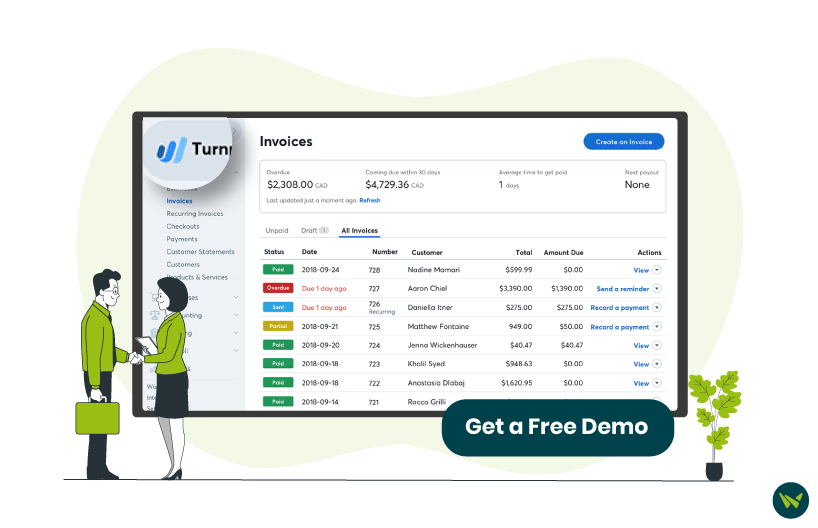

The platform assists accountants and small organizations in efficiently managing payroll management, invoices, and tracking labor costs. By utilizing its cloud-based accounting services, businesses can easily store and migrate data between different platforms and make informed accounting decisions. QuickBooks Intuit provides a 360-degree view of sales and personalized reports, helping employers efficiently evaluate financial matters and do what’s right for their business.

Top Features

- Personalized invoices

- Inventory management

- Data migration

- Project tracking

Pros And Cons

Pricing

In addition to a 30-day free trial, the software offers four pricing plans: Simple Start ($35/month), Essentials ($65/month), Plus ($99/month), and Advanced ($235/month).

Disclaimer: The pricing is subject to change.

Wave Payroll helps organizations manage and track transactions, create personalized invoices, and streamline accounting tasks. S-corp with a limited budget can effortlessly run payroll, pay employees and contractors on time, and maintain tax compliance. The software helps users avoid legal trouble at all steps and supports online payments via several channels, including credit cards, Apple Pay, and bank deposits.

Top Features

- Automatic payments

- 1099 and W-2 tax forms

- Unlimited bookkeeping records

- Automated bank transactions

Pros And Cons

Pricing

Wave offers a free Starter Plan and a Pro Plan ($16/month). For receipt management, a dedicated Receipts plan is available (at $8/month), although this feature is also included in the Pro Plan (at $16/month).

Additionally, professional Bookkeeping support (from $149/month) and Accounting coaching (from $229/month) are available as optional services.

Disclaimer: The pricing is subject to change.

Winding up the above discussion, all the above-mentioned platforms help small businesses and S-corps effortlessly manage financial data and make analytical decisions. However, choosing one platform can be a bit challenging and requires considering several factors, including your workforce size, budget bracket, immediate requirements, etc.

That said, if you are looking for a software that helps you manage payroll as well as workforce tasks, Gusto should be your go-to platform. Patriot Payroll and QuickBooks Intuit are ideal for users needing comprehensive payroll and accounting services. Similarly, for firms needing invoicing and financial management platforms, Wave Payroll can serve them best.

If you are still confused about the right choice and need an expert opinion, get in touch with our software experts and they will help you make a cost-effective decision.