If there’s one system every business relies on, it’s the general ledger—the foundation for clean reporting, consistent records, and confident decision-making. However, not every general ledger software is built the same. Some are built for speed and simplicity, while others focus more on handling complex structures like multiple entities or currencies. Depending on your needs, the right tool can make audits much less stressful.

In this blog, we’ve reviewed nine of the best general ledger software to consider in 2025. For each one, you’ll find its core features, ideal use cases, example customers, and pricing details—helping you figure out which system actually fits your setup. Let’s get into it!

Company | Best For | Main Features | Pricing |

QuickBooks Online | Small businesses, startups, and freelancers | Double-entry GL, automation, 750+ integrations, add-on payroll | Starts at $35/month, 30-day free trial |

Xero | Small to medium businesses needing multi-user access | Unlimited users, multi-currency, 1000+ integrations | Starts at $20/month, free 30-day trial |

Zoho Books | Small businesses on a tight budget | End-to-end accounting, inventory, free plan, affordable pricing | Starts at $0/org/month, free 14-day trial |

Sage Intacct | Mid-market firms needing intelligent GL | Intelligent GL, anomaly detection, multi-book support | Starts at $400/month + $225/user/month |

Oracle NetSuite | Mid-sized businesses needing global consolidation | Custom COA, recurring entries, GAAP/IFRS parallel books | Starts at $999/month + $50-$200 fee/user |

Microsoft Dynamics 365 | Businesses using the Microsoft ecosystem | Multi-entity, dimensional accounting, Excel integration | Starts at $70.00/user/month |

Oracle Fusion Cloud ERP | Enterprises needing intelligent, scalable ERP | Adaptive Intelligence, centralized accounting hub | Starts at $625.00/user/month |

Workday Financial Management | Service-centric firms needing unified HR + finance | Worktags, embedded analytics, operational plus financial insights | Starts at $5,000/month |

FreshBooks | Freelancers and small service-based businesses | Time tracking, invoicing, receipt scanning, basic reports | Starts at $21.00/month, 30-day free trial |

QuickBooks is about as common as it gets when it comes to small business accounting. It offers a full double-entry general ledger and covers all the basics—profit and loss, balance sheet, cash flow reports, and more. The part that usually saves the most time is the automatic bank feeds.

Transactions come in on their own and get categorized, which cuts down on manual entry and keeps your books moving. Sales and expense workflows are built in, so you can invoice, accept payments, and pay bills without jumping between tools. Another important thing is that payroll is available, too, but only as an add-on.

What also helps is how easily it connects with other platforms—QuickBooks supports over 750 integrations, including e-commerce and CRM tools. Globally, over 6.5 million businesses use QuickBooks Online as their ledger and accounting system. TM Thong and Company and Zen Accountants are part of that number.

Best For: It works best for small businesses, startups, and freelancers. The software supports up to 25 users on the Advanced plan and is widely used across industries—from retail and e-commerce to consulting and professional services.

Pricing

Disclaimer: The pricing is subject to change.

Xero Accounting Solution is a full double-entry general ledger software built entirely online, and it’s especially popular for small to mid-sized businesses (SMBs). One thing that stands out is that all its plans include unlimited users, which makes it easier to keep your bookkeeper, accountant, and internal team working from the same set of books.

One of Xero’s standout features is its bank feed setup that supports over 21,000 financial institutions globally—making transactions flow automatically without manual intervention. Another area where Xero performs well is multi-currency accounting (available on higher-tier plans). It handles foreign transactions, revaluations, and currency conversions smoothly—something many tools still struggle with.

With over 1,000 integrations in its app marketplace, Xero connects well with CRMs, inventory systems, and other financial tools. It has 4.4 million subscribers worldwide, with brands like Visual Contrast or Xendoo among its customers.

Best For: It’s particularly favored by SMBs, including startups, that want a full-featured GL (General Ledger) with multi-currency support and easy collaboration with accountants.

Pricing

Disclaimer: The pricing is subject to change.

Despite its low price point, Zoho Books’ feature set is robust. It supports end-to-end accounting: sales orders, invoices, bills, purchase orders, expense claims, project accounting, and even basic inventory tracking (for product businesses).

It’s a fully capable double-entry system with invoicing, expense tracking, and inventory management features, making it comparable to QuickBooks or Xero in functionality. What sets Zoho Books apart is its value: it provides many advanced features at a fraction of the cost of competitors and even offers a free plan for small businesses.

Zoho reports over 120 million users across its full suite of products. Zoho Books is part of that, with companies like Asta Bumi Cipta and Swifty Print Ltd using it for accounting.

Best For: Zoho Books is ideal for small businesses and sole proprietors on a tight budget who still want a full-featured accounting system. Especially those businesses that are already using other Zoho products such as Zoho Sheet and Zoho Projects.

Pricing

Disclaimer: The pricing is subject to change.

Sage Intacct is often considered a step up from entry-level accounting software. Its general ledger is often described as the ‘Intelligent GL,’ and to be fair, it does more than just hold transactions. It can automatically detect anomalies or outliers in transactions, using machine learning (ML) to flag unusual entries for review. This helps catch errors or fraud early.

The software also supports multi-book accounting, meaning you can maintain parallel sets of books (e.g. one for US GAAP, one for IFRS, one for cash basis) and post to them simultaneously, which is critical for global companies. Not only that but companies like Bitly and Burger King already use Intacct to manage their accounting.

Best For: The software is perfect for mid-market companies and organizations that have outgrown basic accounting software and need advanced functionality.

Pricing

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

NetSuite is known for being flexible—and its general ledger reflects that. The chart of accounts can be tailored to fit your setup, and user-defined segments like departments, classes, and locations make it easier to break down financial data the way you manage the business.

What stands out most is how much of the GL process can be automated. NetSuite can pull in bank transactions, auto-match them, post recurring journal entries, and handle accruals or allocations on a set schedule. Once it’s configured, it takes a lot of routine work off the table.

For businesses working across borders or entities, the system’s multi-currency and multi-company support is strong. It handles conversions, consolidations, and local compliance in the background—which is one less thing to manually track.

There’s also a ‘Multiple Books’ feature that lets you maintain parallel ledgers for different standards like GAAP (Generally Accepted Accounting Principles). That’s especially useful for companies balancing internal and external reporting requirements.

It is used by over 41,000 customers, including well-known names like Lettuce Entertain You (hospitality) and Marine Layer (apparel retail).

Best For: It’s best suited for mid-sized businesses or fast-growing small companies that need a full ERP (enterprise resource planning) platform—not just a standalone general ledger. It tends to serve industries like wholesale distribution, manufacturing, retail, technology, and professional services particularly well.

Pricing

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

Business Central is Microsoft’s cloud ERP platform for SMBs, and its general ledger comes with more depth than you'd expect from an entry point into Dynamics. It supports multi-currency, multi-entity, and consolidation and offers a solid range of financial reports right out of the box.

One of the more useful features is dimensional accounting. Like NetSuite and Sage Intacct, Business Central lets you tag transactions with dimensions such as department, project, or region. It’s a cleaner way to segment data without turning your chart of accounts into a mess.

Another strength is how well it integrates with Microsoft tools. Journal entries can be edited and posted directly from Excel, and financial reports open with live data links—handy if your team already works in that ecosystem. With over 45,000 customers, Dynamics 365 Business Central has a wide global reach (available in 160+ countries and multiple languages). Companies like Andretti Indoor Karting & Games and Michelin have been noted as their users.

Best For: Businesses often choose this system when they are already using Microsoft 365 software, Azure, or Dynamics CRM and want seamless integration.

Pricing

Disclaimer: The pricing is subject to change.

Oracle Fusion Cloud ERP is designed for enterprises that deal with complex financial operations. Its general ledger is flexible enough to handle multi-ledger and multi-currency setups without much friction—something that becomes essential when you’re dealing with multiple entities, regulatory standards, or global reporting.

Where it tries to differentiate itself is with built-in intelligence. Oracle’s ‘Adaptive Intelligence’ features help automate tasks like invoice coding, flagging outliers in expenses, and forecasting trends. Some features work well out of the box, but they’re especially valuable in larger environments where manual reviews slow things down.

One feature that stands out in real-world use is the Accounting Hub. It lets Oracle act as a central GL, pulling transactions from different systems—including non-Oracle ones—and applying uniform accounting rules. That’s a big help if your financial data is scattered across platforms and you need one place to standardize it.

Oracle reports almost 11,000 organizations across industries are using Oracle Cloud ERP. DHL Supply Chain, for example, uses it to unify financial processes across 40+ countries.

Best For: Mostly ideal for large enterprises and upper mid-market companies that want a complete, cloud-based ERP with cutting-edge technology.

Pricing

Disclaimer: The pricing is subject to change.

Workday is best known for its HR tools, but the Workday Financial Management platform brings the same level of structure and flexibility to accounting. The general ledger doesn’t rely on a traditional account code structure. Instead, it uses ‘Worktags’—flexible labels that let you tag transactions by project, department, or other dimensions.

This makes the reporting more flexible without overloading the chart of accounts. For teams that need multi-dimensional reporting but want to avoid rigid account structures, it’s a big plus. Another key feature is embedded analytics: it captures not just financial amounts but also operational details at the point of transaction (because of its HR and operational context).

According to Workday Financial Management, more than 10,500 organizations use the platform. That includes companies like Shelter Insurance, Coventry Building Society, and Stout.

Best For: Service-centric organizations (consulting firms, universities, hospitals) find Workday attractive because it can manage both the workforce and the finances in one place.

Pricing

Disclaimer: The pricing has been sourced from third-party websites and is subject to change.

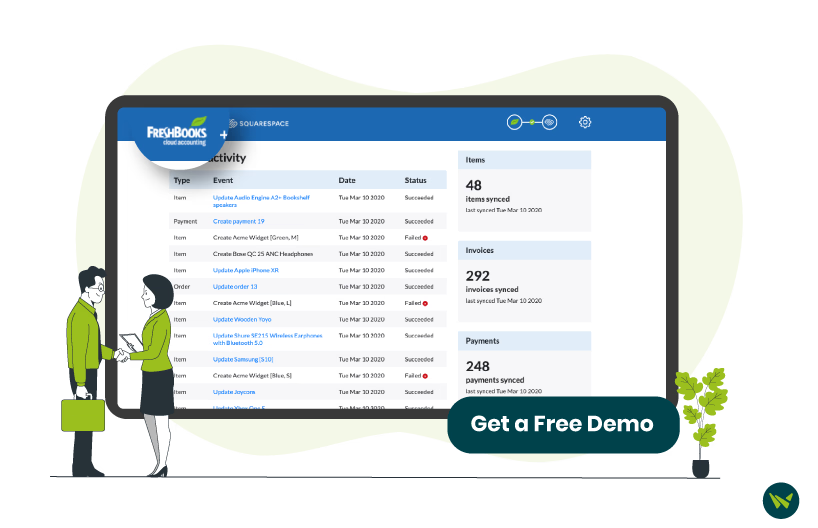

FreshBooks software started as an invoicing tool and later expanded into a general ledger system with double-entry accounting features. It offers a streamlined set of features centered around what small service businesses need. This includes intuitive invoicing (with professional invoice templates that can be emailed and paid online), expense tracking (users can snap photos of receipts and have FreshBooks categorize them), and time tracking (a built-in timer and project tool to log hours and convert them into invoices).

It's worth noting that it provides basic financial reports like profit and loss, balance sheet, and cash flow, which are easy to generate. Another recent addition is bank feeds: FreshBooks can connect to bank accounts and credit cards to import transactions, making reconciliation simpler (though this feature is somewhat simpler than in full-fledged GL systems). FreshBooks reports that 30M+ people have used the platform, which likely includes many who tried the product.

Best For: It is best for freelancers, solo entrepreneurs, and small businesses (under 10 employees), especially those in service industries. This includes creatives (designers, writers, photographers), consultants, marketing agencies, tradespeople.

Pricing

FreshBooks comes with a 30-day free trial and offers the following pricing options:

Disclaimer: The pricing is subject to change.

The truth is not every business needs an enterprise-grade ledger system—and not every tool is built for scale. That’s why choosing the right one depends more on how your company works than on feature lists alone.

If you need to track income, send invoices, and stay organized for tax time, tools like FreshBooks, Zoho Books, or QuickBooks Online work with minimal setup. For more complex needs—like handling multiple departments, currencies, or approval workflows—NetSuite, Business Central, or Sage Intacct offer better structure and automation. If you're managing finances across countries or business units, enterprise platforms like Oracle Cloud ERP or Workday provide the control and scalability that smaller tools lack.

Use the insights from this list to weigh your options and choose the system that best fits how the business operates. If you want to compare them in more detail, check out our resource center for side-by-side breakdowns.